Business Formation

https://www.corpnet.com/partners/business-formation-guidance/

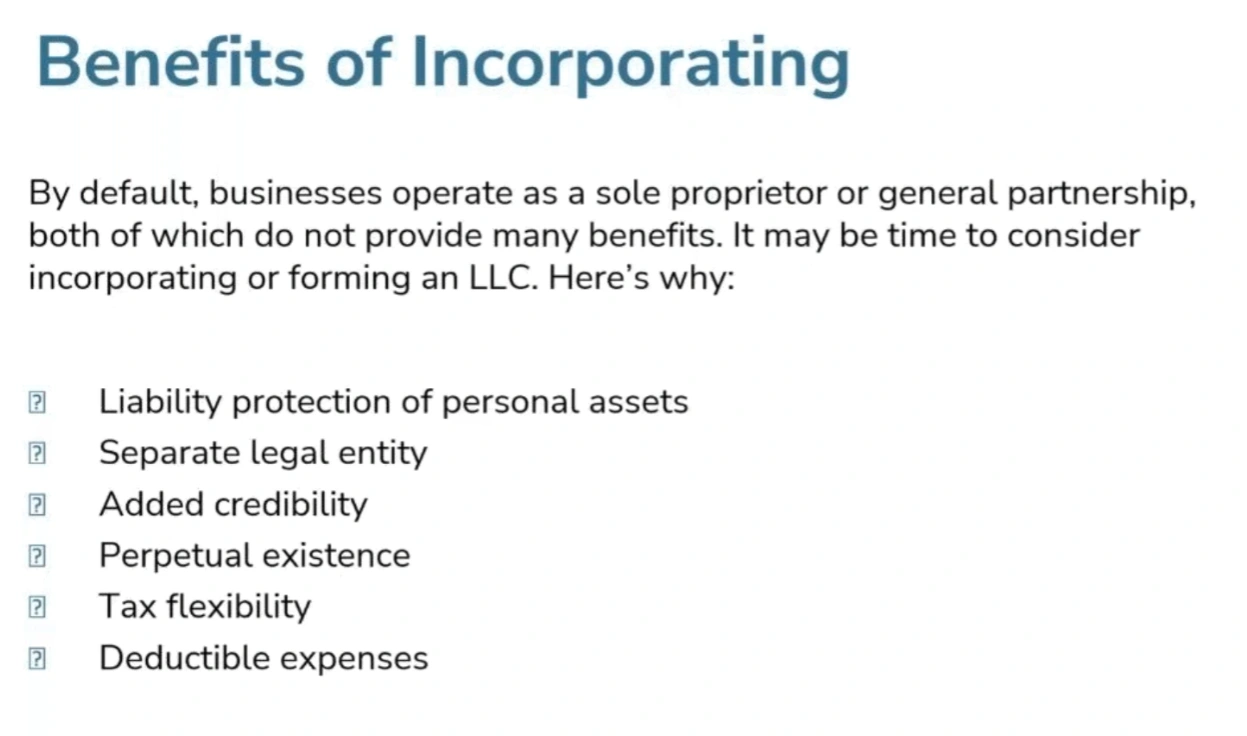

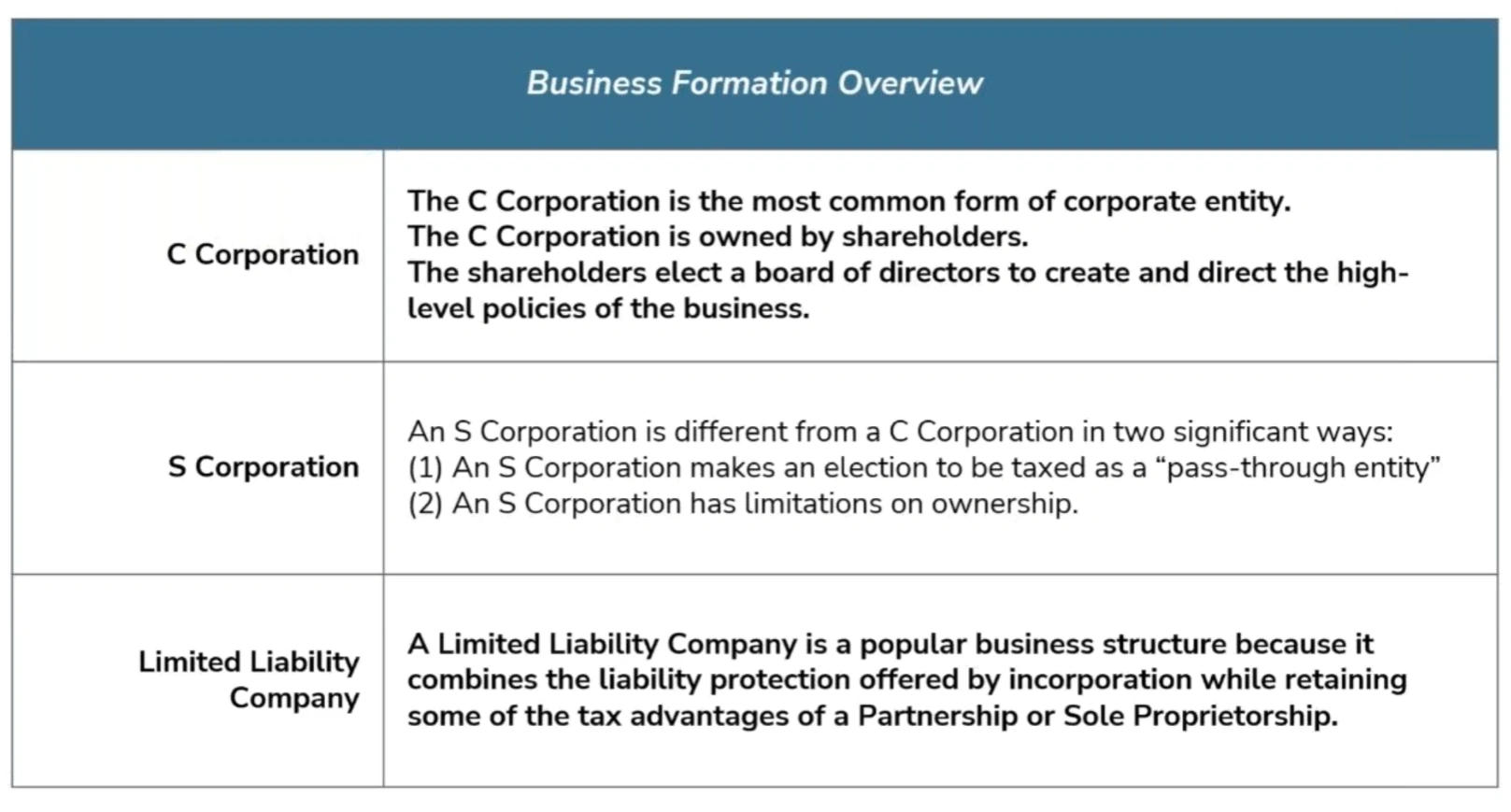

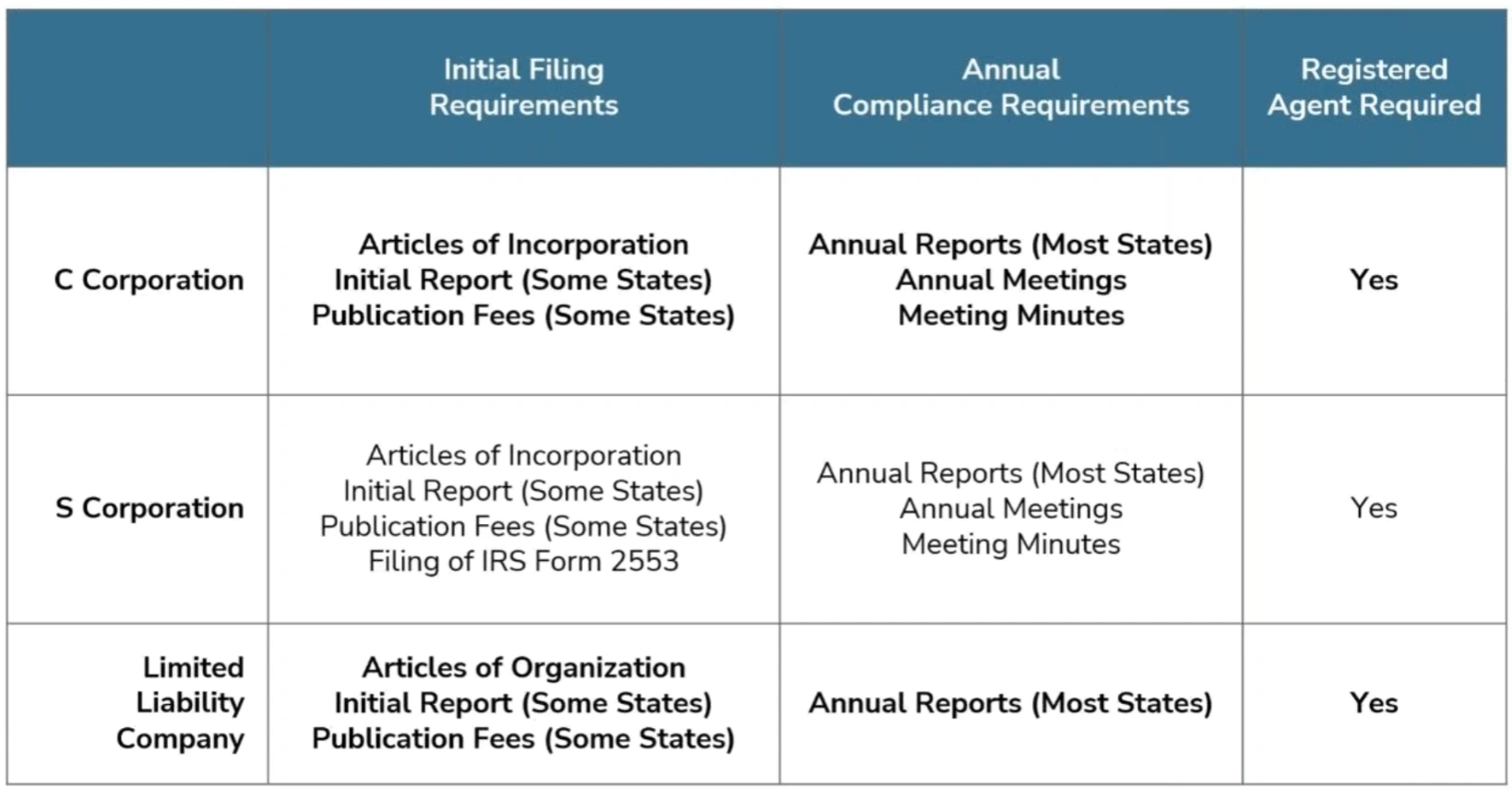

Business structure: Deciding on the legal structure of the business is an important first step. Each structure has different legal and tax implications, and it is important to choose the one that best suits the needs of the business. The most common structures are sole proprietorship, partnership, limited liability company (LLC), and corporation

DBA - Doing Business As

- register D.B.A.

Sole Proprietorship

- An EIN might be needed for business banking or hiring contractors.

- Registration for tax purposes with the state is also required.

- However, personal assets are at risk with this structure.

- Business income and losses are reported on your personal tax return (Schedule C) and are subject to self-employment tax.

Table 2: Comparison of Legal Structures: LLC vs. Sole Proprietorship

| Feature | LLC | Sole Proprietorship | Advantages for Your Situation | Disadvantages for Your Situation |

|---|---|---|---|---|

| Liability Protection | Limited personal liability for business debts | Unlimited personal liability for business debts | Protects personal assets from business risks | None |

| Taxation | Pass-through taxation (default); option for S-corp or C-corp election | Pass-through taxation on personal income tax return (Schedule C) | Flexibility in tax options, potential self-employment tax savings with S-corp | No liability protection, self-employment tax applies |

| Setup Complexity & Cost | More complex, requires filing with the state and fees ($125 formation, $75 annual report + $150/member Minimum Partner Tax) | Simple, no formal filing required initially (trade name registration with county if needed, ~$50) | Provides legal protection | Higher initial and ongoing costs, more administrative burden |

| Administrative Burden | Ongoing requirements include annual report, operating agreement | Minimal ongoing requirements | Separate legal entity enhances credibility | Personal liability exposure, may be harder to secure business financing |

| Credibility | Generally higher perceived credibility | May be perceived as less formal | More formal structure can enhance trust with clients and partners | May be suitable for initial bootstrapping but lacks liability protection |

Table 3: New Jersey LLC Formation and Name Change Costs and Procedures

| Action | Procedure | Estimated Cost | Relevant Snippet IDs |

|---|---|---|---|

| Check Name Availability | Use online business name search tool | Free | 118 |

| Reserve LLC Name (Optional) | File Form UNRR-1 online | $50 | 55 |

| File Certificate of Formation (New LLC) | Online or by mail | $125 | 55 |

| File Certificate of Amendment (Name Change) | File Form L-102 online or by mail | $100 | 45 |

| Obtain EIN | Apply online, by mail, or fax with the IRS | Free | 55 |

| File Business Registration Application (NJ-REG) | Online or by mail | Free | 55 |

QBI Limits the 199A Deduction

- QBI is a business's net amount of qualified income, gain deduction, and loss.

- QBI must be effectively connected to a US business, and it is included determining taxable income.

- QBI does not include the following:

- Investments-dividends, interest capital gains.

- Compensation paid to an owner for services rendered with respect to the trade or business: guaranteed payments, reasonable compensation, payments to a partner for services rendered, or W-2 Income