Funding

BOOTSTRAPPING

Financing a startup business without loans or investors

general requirements that startups may need to meet in order to be eligible for seed funding

Seed funding is typically the first round of capital that a startup raises, which is used to fund the initial development of the product or service. The requirements for seed funding can vary depending on a number of factors, including the industry, the stage of the startup, and the investors.

A clear and compelling business idea: Seed investors want to see that a startup has a unique and innovative business idea that has the potential to solve a real problem in the market.

A strong team: Investors want to see that the startup has a team with the skills and experience necessary to execute on the business idea. This includes technical expertise, industry knowledge, and business acumen.

A prototype or minimum viable product (MVP): Investors want to see that the startup has made progress in developing its product or service, and that it has validated its assumptions through customer feedback and testing.

A viable market: Investors want to see that the startup has identified a target market that is large enough to support its business idea, and that there is potential for growth and profitability.

A realistic financial plan: Investors want to see that the startup has a clear understanding of its financials, including its burn rate, projected revenue, and cash flow projections.

Keep in mind that these are general requirements, and the specific requirements for seed funding can vary depending on the investor and the industry. It's important to research the requirements of different investors and tailor your pitch accordingly.

Funding Requirements

Start small: Begin by offering a few marketing services that you are skilled in, such as social media management or email marketing. As you gain more clients and revenue, you can expand your services.

Work from home: Keep your overhead costs low by working from home or a shared workspace instead of renting an office space.

Leverage your network: Reach out to your personal and professional network to offer your marketing services and generate referrals. This can help you build your client base and generate revenue.

Utilize social media: Use social media platforms like LinkedIn, Twitter, and Facebook to promote your marketing services and build your online presence. Be sure to post regularly and engage with your followers to build a strong online presence.

Focus on inbound marketing: Inbound marketing techniques, such as content marketing and search engine optimization (SEO), can help you attract potential clients to your website and generate leads.

Offer free consultations: Offer free consultations to potential clients to showcase your expertise and build trust. This can help you convert leads into paying clients.

Manage your finances: Keep track of your expenses and income using a bookkeeping system. This can help you stay organized and make informed decisions about your finances.

| Terms | Defintion |

|---|---|

| Pre-seed | $75k check |

| seed | $250k check, usually a team of 3-4 people |

Examples of famous companies that started with MVP

| Company | Seed Capital |

|---|---|

| ($250,000 in 9 months) | |

| ($50,000 to $250,000) | |

| Uber | ($1M to $1.5M) |

| ($250,000 in 9 months) | |

| ($120,000 in 4 months) | |

| Shopify | ($250,000 and $300,000 in 4-6 months) |

Pre Revenue Funding

The following section shows how we are currently looking to raise money to begin our initial startup phase. We are considering approaching various avenues of funding and investors in order to achieve our goal.

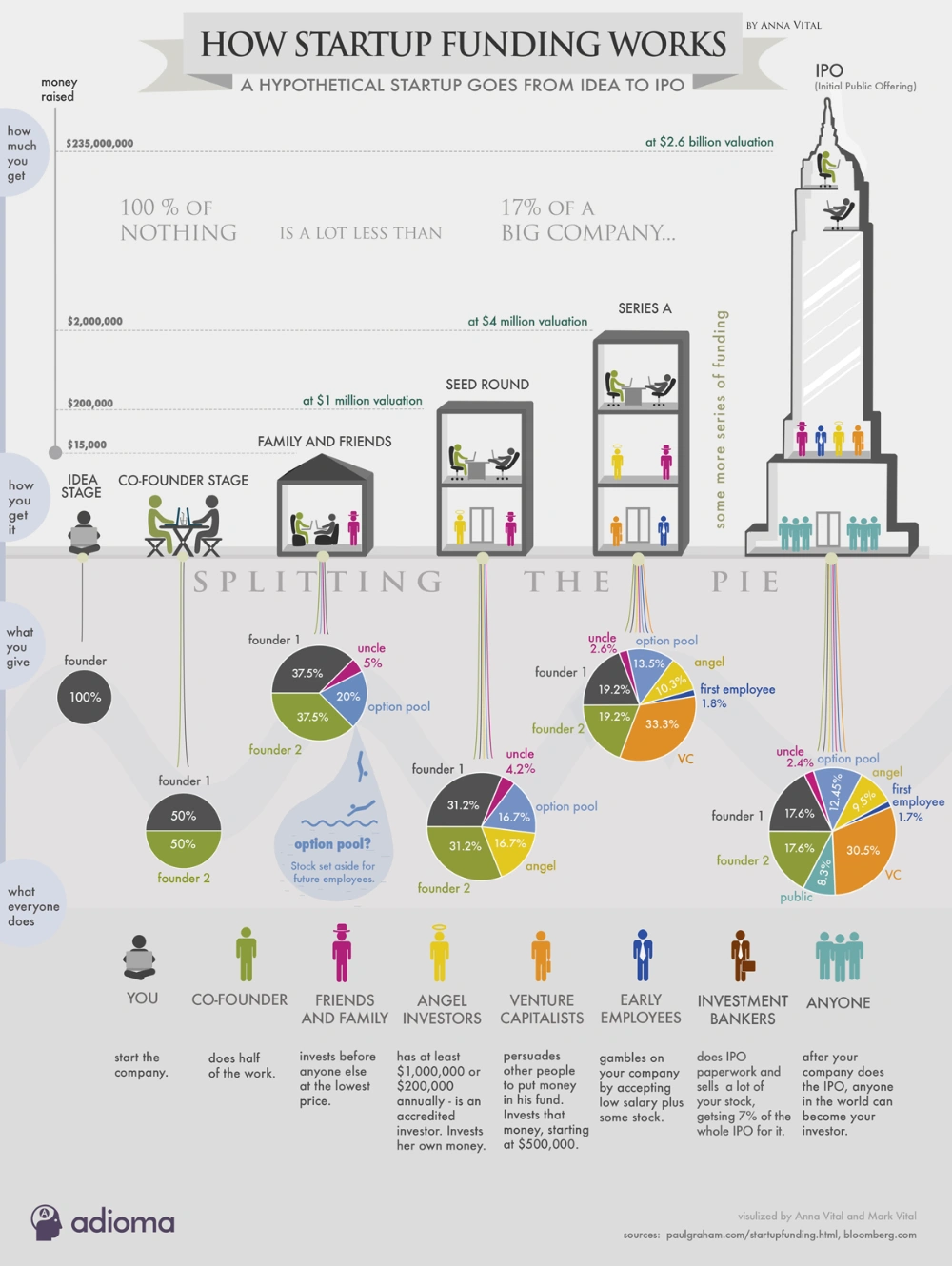

Seed funding: Seed funding is typically the first round of funding that a startup raises. It is usually provided by angel investors or venture capital firms and is used to help the company get off the ground. Seed funding can be used to cover expenses such as product development, marketing, and hiring.

Crowdfunding: Crowdfunding is a popular way for startups to raise capital from a large number of individual investors. Crowdfunding platforms like Kickstarter and Indiegogo allow startups to pitch their ideas and raise money in exchange for rewards or equity in the company.

Accelerator programs: Accelerator programs are designed to help startups grow quickly by providing them with mentorship, resources, and funding. In exchange for a small amount of equity, startups receive funding, office space, and access to a network of investors and mentors.

Friends and family: Many startups raise their first round of funding from friends and family members who believe in their idea and want to support them. This can be a good option for startups that need a small amount of capital to get started.

Grants: Some startups may be eligible for government grants or other types of funding that do not require equity or repayment. These grants may be based on factors such as the company's mission, location, or industry.

It's important for startups to carefully consider their pre-revenue funding strategy and choose the option that best fits their needs and goals. It's also important to have a solid business plan and a clear understanding of the company's financial needs and projections.

CUSTOMERS ARE THE BEST SOURCE OF FUNDING

| Option | Description |

|---|---|

| Crowdfunding | Crowdfunding is a way to raise funds from a large group of people, typically through an online platform. You can offer rewards or equity in your company in exchange for contributions. |

| Bootstrapping | Bootstrapping means keep costs low and slowly build your business over time by funding your business with your own savings and revenue from the business itself. This will be challenging in the early stages, but it allows you to maintain control over your business and avoid debt. |

| Grants | There are various grants available for startups, particularly those in certain industries or with a social impact. Research and apply for grants that align with your business goals. |

| Accelerator programs | Many cities and regions have accelerator programs that provide mentorship, resources, and sometimes funding to startups. These programs can help you grow your business and attract investors in the future. |

| Pre-sales | If you have a product or service that you can sell before it's fully developed, you can use pre-sales to generate revenue and fund your business. This requires a strong marketing plan and a product that people are excited about. |

| Bartering | You can barter your skills or services with other businesses to obtain goods or services that you need to run your business. This can help you save money and build relationships with other entrepreneurs. |

Bootstrapping

Bootstrapping your side hustle means that you will be self-funding your business without external investors or loans.

- 627,000 businesses are started each year

- only ~8,500 received formal equity investment

- 1/3 of small businesses began with less than $5,000

Set a budget: Start by creating a budget for your side hustle. This will help you understand your expenses and figure out how much money you need to generate in order to break even and eventually turn a profit.

Use your savings: If you have savings, consider using some of that money to fund your side hustle. This can be a good way to get started without taking on debt or giving up equity in your business.

Start small: Don't try to do everything at once. Instead, focus on starting small and building momentum over time. This will help you minimize your expenses and reduce your risk.

Keep your day job: If you have a day job, consider keeping it while you build your side hustle. This will provide you with a steady income while you work on your business in your spare time.

Use low-cost tools: There are many low-cost or free tools available that can help you run your side hustle. For example, you can use free tools like Canva or Hootsuite to create marketing materials and manage your social media accounts.

Leverage your network: Reach out to your personal and professional network to help spread the word about your side hustle. Ask for feedback and support, and consider offering incentives for referrals or for sharing your business on social media.

Focus on revenue-generating activities: In the early stages of your side hustle, focus on activities that generate revenue. This might include selling products or services, or finding ways to monetize your skills and expertise.

Stay focused, be strategic with your resources, and keep your long-term goals in mind.

Bootstrapping a startup with commission compensation

- it's an effective way to manage costs and incentivize your team to work hard and achieve results.

- consider your goals, targets, and team dynamics to ensure that your commission structure is effective and sustainable.

Define your commission structure: Determine how you will calculate commissions, such as a percentage of sales, a flat fee per transaction, or a combination of both. You should also establish the timing of commission payments, such as monthly, quarterly, or annually.

Set clear goals and targets: To incentivize your team to work towards specific goals, you should set clear targets and milestones that align with your business objectives. Your commission structure should be tied to these goals, so that your team members are motivated to achieve them.

Hire the right team: Look for individuals who are motivated by commission-based compensation and have the skills and experience needed to achieve your business objectives. It's important to hire individuals who are self-driven and can work independently to achieve results.

Monitor performance: Keep track of your team's performance and provide regular feedback on their progress towards achieving their goals. This will help you identify areas for improvement and ensure that your commission structure is effective in motivating your team.

Be transparent: It's important to be transparent about your commission structure and how it works. This will help your team members understand how they can earn commissions and what they need to do to achieve their goals.

Consider non-monetary incentives: In addition to commission compensation, you can also consider offering non-monetary incentives, such as recognition, flexible work arrangements, or professional development opportunities. This can help motivate your team and create a positive work environment.

Overall, a commission-based compensation structure can be an effective way to bootstrap your startup and motivate your team to achieve results.

Strategies for Tech Startups: Building Without Venture Capital

Three essential strategies for starting, growing, and eventually selling a company without relying on venture capital. For tech startups, these insights can be particularly valuable in navigating the competitive landscape while maintaining independence.

1. Bootstrapping Your Startup

- Summary: Begin by funding your startup through personal savings, revenue, or small loans. This approach allows for greater control over your business and decision-making.

- Tech Twist: As a tech startup, consider leveraging low-cost tools and platforms to build your product. Utilize open-source software, cloud services, and no-code/low-code platforms to minimize initial expenses and develop a minimum viable product (MVP) quickly.

2. Focus on Revenue-Generating Strategies

- Summary: Prioritize building a business model that generates revenue early on. This can involve offering services or products that customers are willing to pay for from the outset.

- Tech Twist: In the tech space, explore subscription models or freemium services that provide immediate value while allowing you to capture revenue. Early customer feedback from these models can inform product iterations and help refine your offering.

3. Build a Strong Network and Community

- Summary: Establish a network of mentors, advisors, and like-minded entrepreneurs. Engaging with a community can provide support, guidance, and potential partnerships.

- Tech Twist: Actively participate in tech meetups, hackathons, and online forums to connect with other founders and potential customers. Building a community around your product can create a loyal user base and enhance word-of-mouth marketing.

Conclusion

For tech startups, starting, growing, and selling a company without venture capital is not only feasible but can also lead to greater autonomy and a stronger brand identity. By bootstrapping effectively, focusing on revenue early, and fostering a robust network, you can build a sustainable business model. This approach not only enhances your chances of success but also positions your startup attractively for future buyers, allowing for a successful exit when the time is right.

Embracing these strategies can empower tech entrepreneurs to navigate their journey with confidence and creativity, leading to innovation without the constraints often imposed by outside investors.

Company Valuation