Funding

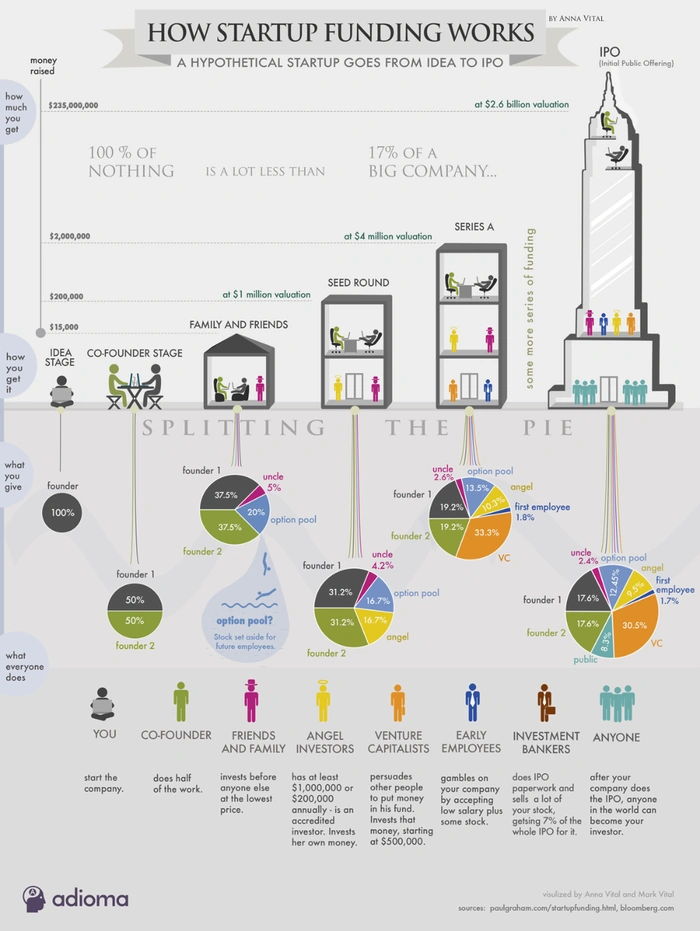

Startup funding refers to the capital that entrepreneurs seek to start, grow, and scale their businesses. The funding journey typically progresses through several stages, each with its own challenges and requirements. Understanding these stages can help entrepreneurs navigate potential pitfalls and secure the necessary resources.

Stages of Startup Funding

- Uber had an early investor that gave $200k for 5% which is now worth ^ $20M

- This means uber was able to persuade the investor that the “idea” was worth $4M, that proves it right that its worth $20M

- https://workweek.com/brand/just-raised/

- how much: ask for 18-24mos of runway

https://themindstudios.com/blog/how-to-get-funding-for-an-app/ https://www.spaceo.ca/guide/mobile-app-funding/

1. Pre-Seed Stage

Pre-seed vs. seed funding: What’s the difference? The pre-seed round has some overlap with seed funding. Both share the fact that founders are asking for money for a product that has yet to prove its potential within the market.

Pre-seed investment always comes before seed funding. The easiest way to tell the difference is that pre-seed fundraising is an investment in an idea. In other words, it’s an investment in a product that has yet to find its market. Because pre-seed funding involves betting on an idea, it is typically more challenging to secure. To investors, providing capital at the pre-seed stage is a much more significant risk as that product may never even make it to market.

- Overview: This is the very early phase where founders develop their idea. Funding often comes from personal savings, friends, and family.

- Challenges: Many startups struggle to validate their concept or get initial traction. Without a clear value proposition or market research, it can be difficult to attract investors.

2. Seed Stage

investors seek seed funding for a product that already exists and typically has some form of a customer base.

- Overview: At this stage, startups seek to build a prototype or MVP (Minimum Viable Product) and may look for funding from angel investors or crowdfunding.

- Challenges: Founders often face difficulties in demonstrating product-market fit. If the MVP doesn’t resonate with early users, it can lead to a loss of confidence and funding opportunities.

3. Early-Stage (Series A)

- Overview: Startups that have a viable product and some market traction may seek Series A funding to scale operations, enhance the product, and grow their customer base.

- Challenges: Entrepreneurs can struggle with proving scalability. If the business model is not clearly articulated or the growth metrics aren’t compelling, it can hinder attracting institutional investors.

4. Growth Stage (Series B and beyond)

- Overview: At this stage, companies focus on expanding their market reach, refining their product, and increasing revenue. Funding often comes from venture capital firms.

- Challenges: Many startups get stuck due to unsustainable growth strategies or failure to adapt to market changes. Investors expect significant growth, and if startups can’t deliver, it can lead to funding challenges.

5. Pre-Revenue Stage

- Overview: This stage refers to startups that are still in development and have not yet generated revenue. They rely heavily on investor confidence and vision.

- Challenges: Startups in this stage often face the biggest hurdles in securing funding. Without revenue, it can be difficult to validate the business model, making it challenging to convince investors of potential profitability. Many startups fail here due to:

- Lack of traction: Without any sales or user engagement, it’s tough to demonstrate market demand.

- High uncertainty: Investors may perceive a higher risk in pre-revenue companies, leading to reluctance in funding.

6. Exit Stage

Contrary to popular opinion, quitting is for winners. Knowing when to quit, change direction, leave a toxic situation, demand more from life, give up on something that wasn't working and move on, is a very important skill that people who win at life all seem to have.

- Overview: The exit stage involves selling the company, either through acquisition or IPO (Initial Public Offering).

- Challenges: Entrepreneurs can struggle with valuations and negotiating terms with potential buyers. If the startup hasn’t built a strong brand or customer base, it may not attract the desired offers.

- potential strategies are complex and diverse

- research each possible outcome

- reactionary scenario

In the scenario where our company is able to grow but not post any meaningful profits, we will continue until we can either turn the company around in terms of net income or leave the business altogether. This would cause a founder breakup and selling off of company assets. Our potential exit strategies are complex and diverse. We have carefully researched each possible outcome and reactionary scenario given either the success, growth, stability, or failure of our business venture. In the worst case scenario, we will most likely enter bankruptcy and liquidate our assets provided that we still owe our lenders outstanding debt. In this case, equity investors would not recuperate their investments and founders would be forced to give up control of the company.

In the middle scenario where our company is able to grow but not post any meaningful profits, we will continue until we can either turn the company around in terms of net income or leave the business altogether. This would cause a founder breakup and selling off of company assets. In the best case scenario for our company, the founders believe that an IPO or acquisition would be appropriate. An IPO would allow us to raise funds for expansionary projects that we are passionate about, whereas an acquisition would allow our company’s proprietary knowledge and intellectual property to be transferred to another takeover company that would move our products forward. This option would allow for a reasonable return for both our founders and all of the investors in our company.

Startup Exit Value In most cases, your equity’s value depends on the exit value of the company when it IPOs or is acquired. Not sure how to estimate your startup’s exit value? See our startup company exit data by founding date and/or industry to see the historical exit values of other startups, then use the data to estimate a likely exit value for yours.

Conclusion

Navigating startup funding requires a clear strategy and understanding of each stage's challenges. Many startups get stuck in the pre-revenue stage due to a lack of traction and investor confidence. By focusing on validating their ideas early, demonstrating market demand, and being adaptable, entrepreneurs can improve their chances of moving through the funding stages successfully. Building a strong network and seeking mentorship can also provide valuable guidance throughout the process.