Bookkeeping

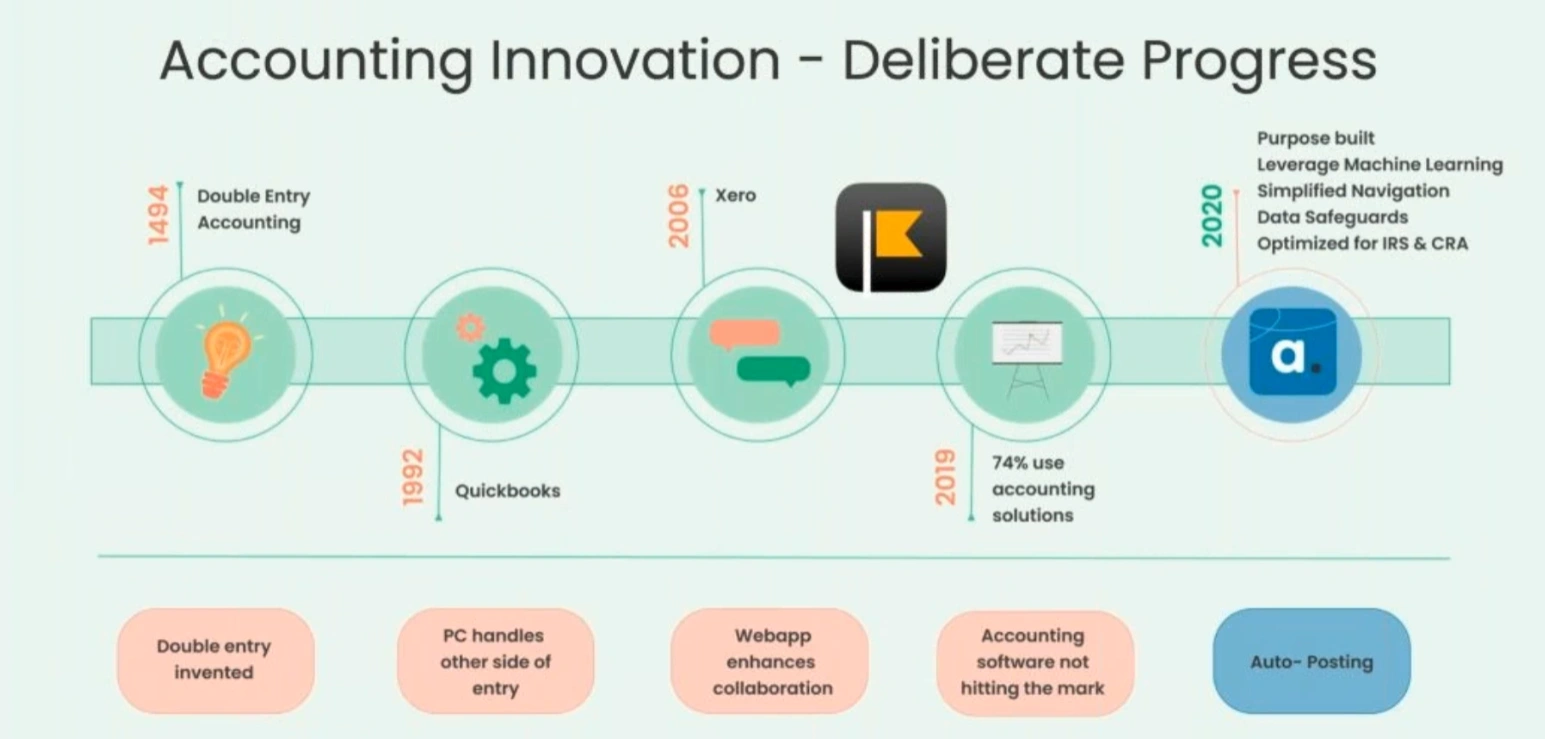

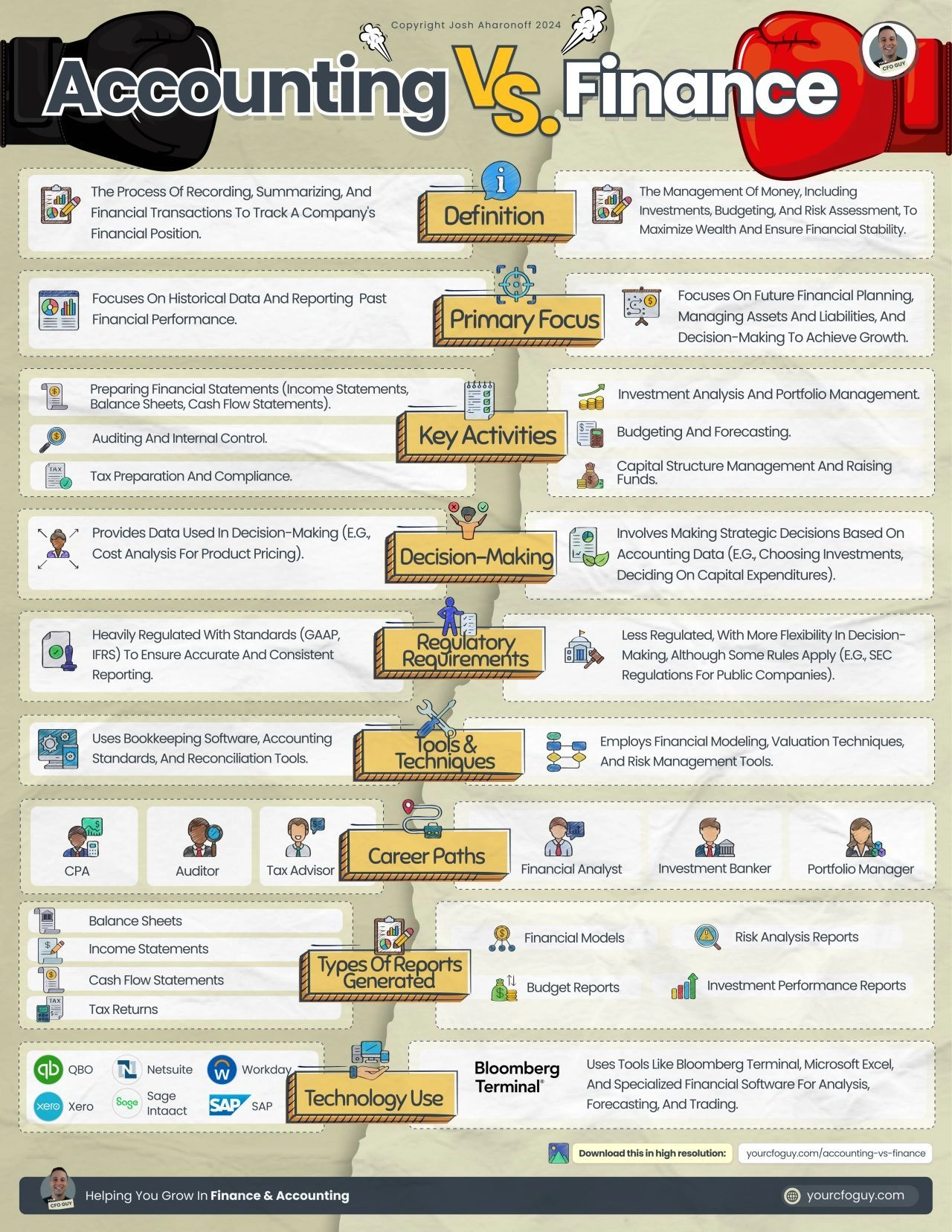

Bookkeeping is the preservation of a systematic, quantitative record of financial activity for businesses to follow. The process of capturing, recording, maintaining, and organizing accurate financial records, financial transactions, and financial information. The purpose is to use the insights gained to make informed decisions and meet financial obligations.

Table of Contents

Sm Biz Accounting Workflow

process to go from books to taxes.

End to End Accounting lifecycle

- Manage, Balance, Maintain, and Close the books

- Prepare Financial Reports

- Report on Taxes

1. Manage

- Obtain

- Organize

- Record

- Classify

- Verify

2. Balance

- Reconcile

- Validate

- Review

- Reclassify

- Report

3. Maintainence

- Projections

- Compliance

- Payments

- Analyze

- Metrics

4. Close

Record every transaction: Every financial transaction, such as sales, purchases, and payments, should be recorded in a bookkeeping system.

Keep accurate records: The records should be accurate and complete, and they should provide a clear picture of the financial health of the business.

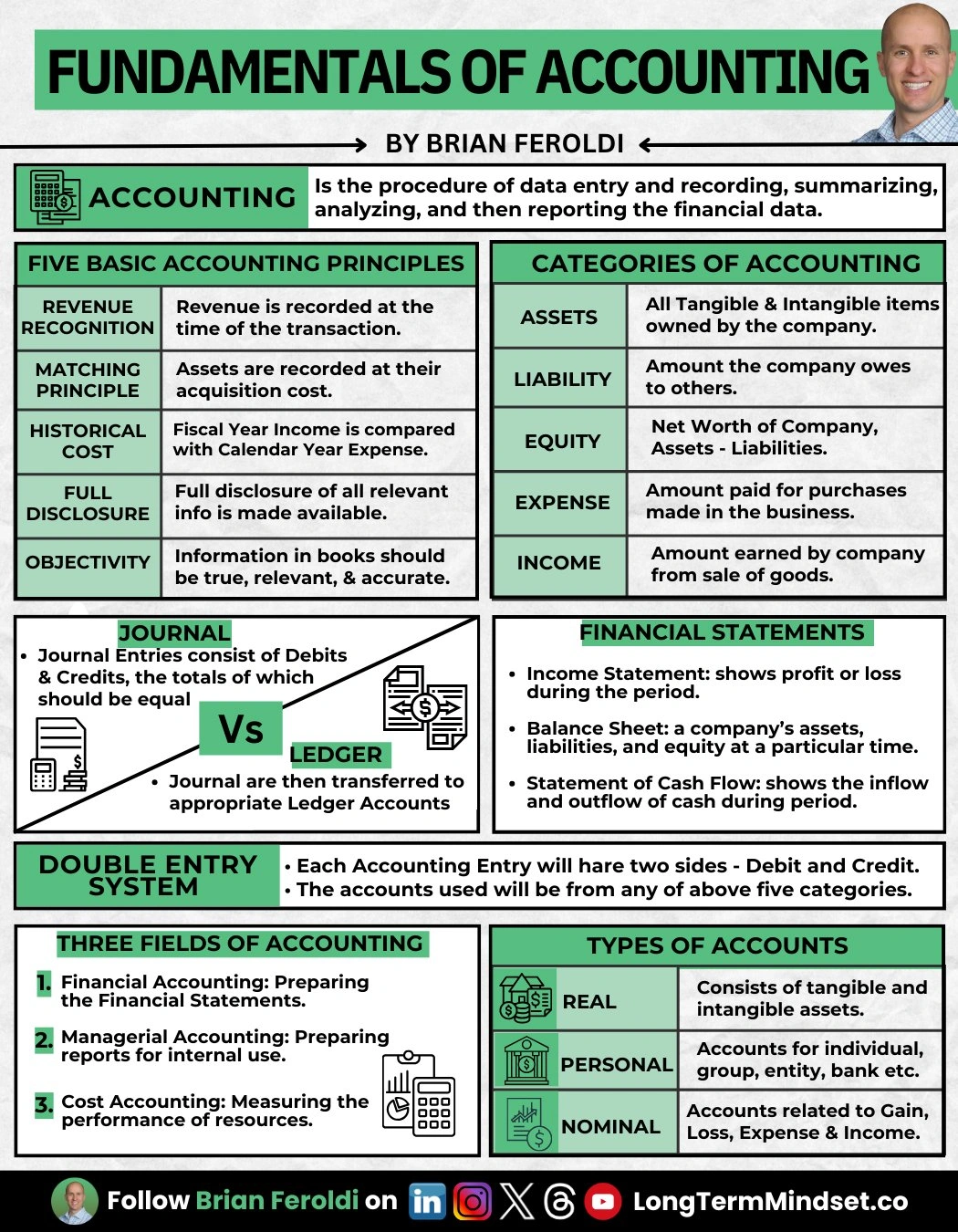

Use a double-entry system: Bookkeeping is typically done using a double-entry system, which means that each transaction is recorded in two accounts: a debit account and a credit account.

Separate business and personal finances: Business finances should be kept separate from personal finances, and business transactions should be recorded separately from personal transactions.

Maintain supporting documentation: Supporting documentation, such as receipts, invoices, and bank statements, should be kept to support the recorded transactions.

Reconcile accounts regularly: Accounts should be reconciled regularly to ensure that the recorded transactions match the actual transactions.

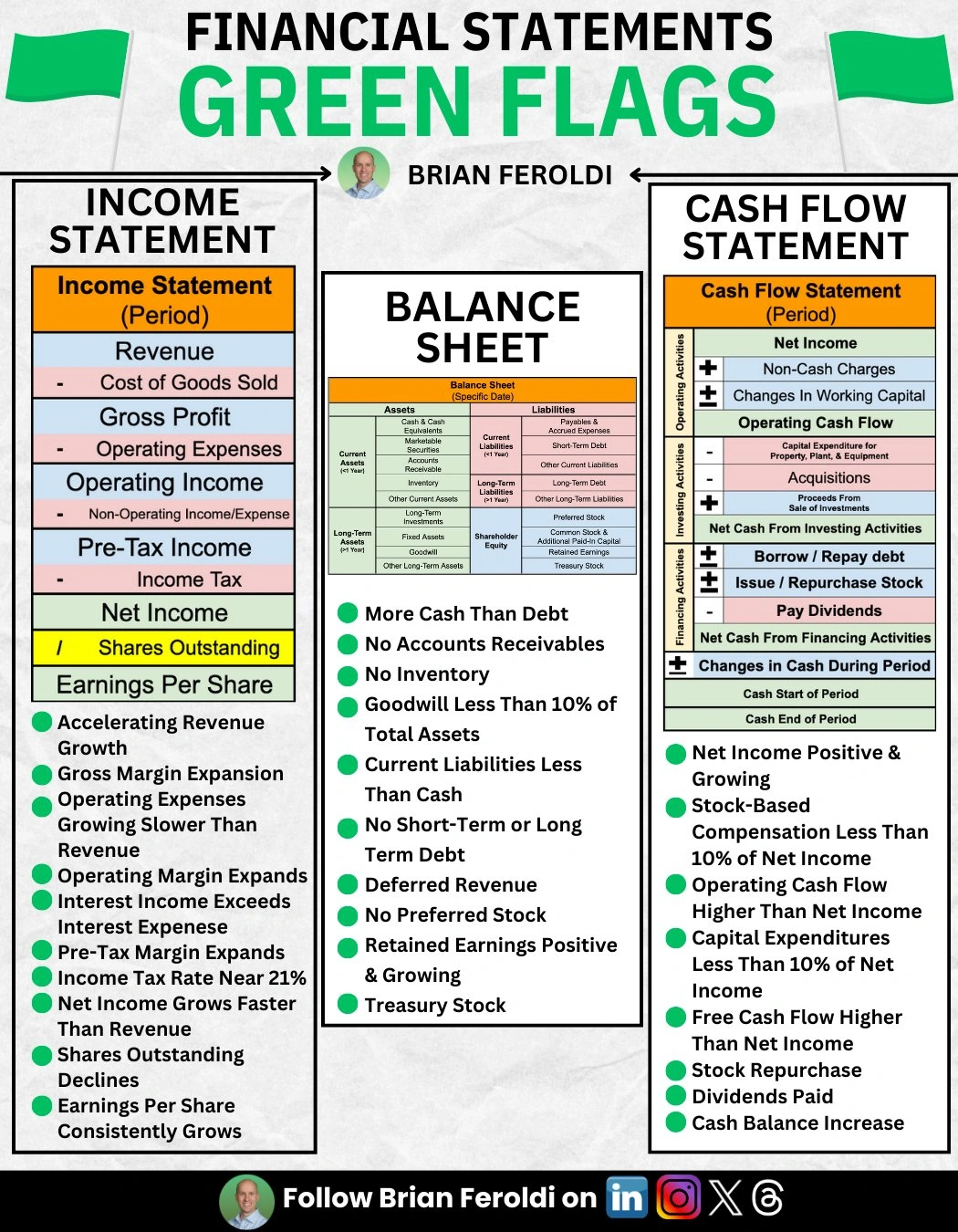

Produce financial statements: Financial statements, such as the balance sheet and income statement, should be produced regularly to provide an overview of the financial health of the business.

How to do your own bookkeeping

chart of accounts has four account categories:

- Asset accounts

- Liability accounts

- Income accounts

- Expense accounts

Set up a chart of accounts: A chart of accounts is a list of all the accounts you will use to record your business transactions. Set up a chart of accounts that is tailored to your business needs.

Record transactions: Record all of your business transactions, including income, expenses, and other financial transactions, in your bookkeeping system. Be sure to include all relevant information, such as the date of the transaction, the amount, and the description.

Reconcile accounts: Reconcile your accounts at the end of each month to ensure that your records match your bank statements.

Produce financial statements: Produce financial statements, such as balance sheets and income statements, regularly to help you understand the financial health of your business.

Stay organized: Keep all of your financial records organized and easily accessible. This will make it easier to track your business finances and to prepare your tax returns.

Choose a bookkeeping system that works best for you and your business: There are various electronic bookkeeping software systems available,

the common dates found on a bill

To differentiate between these dates, the statement or bill date is the date on which the bill was generated or issued, while the billing period refers to the period for which the charges are being billed. The due date, on the other hand, is the date by which the payment must be made to avoid any late fees or penalties.

Statement date: This is the date on which the bill was issued or generated by the company or service provider. It is usually found at the top of the bill and indicates the starting point of the billing period.

Due date: This is the date by which the payment must be made to avoid late fees or penalties. It is usually indicated on the bill and is typically a few weeks after the statement date. The due date is not always a fixed number of days after the statement date. It may be 30 days after the statement date. However, in other cases, the due date may be a specific date, such as the 15th of the month following the statement date.

Bill date: This is similar to the statement date and refers to the date on which the bill was generated or issued. It may also be used interchangeably with the statement date.

Billing period: This refers to the length of time for which the bill is being issued. It is usually indicated on the bill and covers the period between the start and end dates of the billing cycle. For example, if the billing period is from 1st July to 31st July, the bill will cover all the charges incurred during this period.

Wave

Wave is a popular cloud-based accounting and bookkeeping software that is designed for small businesses. Here are some common pros and cons of Wave based on online reviews:

Pros

Free to use: Wave offers a basic version of their software for free, which makes it an attractive option for small businesses with limited budgets. Easy to use: Many users find Wave easy to set up and use, even if they have limited bookkeeping experience. Comprehensive features: Wave includes a range of features, such as invoicing, expense tracking, and receipt scanning, making it a comprehensive bookkeeping solution. Integrations: Wave integrates with a range of other business tools, such as PayPal and Etsy, to help streamline your bookkeeping processes.

Cons

Limited customer support: Some users have reported difficulties getting in touch with Wave's customer support team, which can be frustrating if you need help with an issue. Limited customization: While Wave includes a range of features, some users have reported that it can be difficult to customize reports or invoices to their specific needs. Security concerns: As a cloud-based software, there are concerns about the security of Wave's data storage and the potential for data breaches. Overall, Wave is a popular bookkeeping solution for small businesses, offering a range of features at an affordable price point. However, it's important to consider your specific business needs and to do your research before choosing any bookkeeping software.