Cash Flow Forecasting

2025 Example

RC Reports $43,000 / mo subscription pricing from 27 Clients = Average $1,592 / mo $43,000 * 12 mo = $516,000 / yr

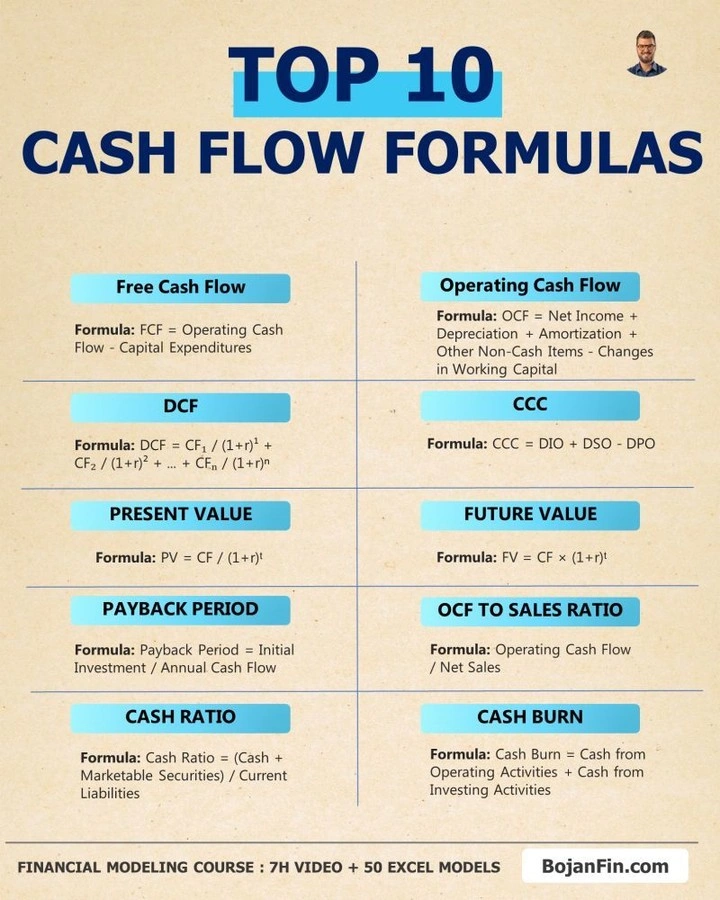

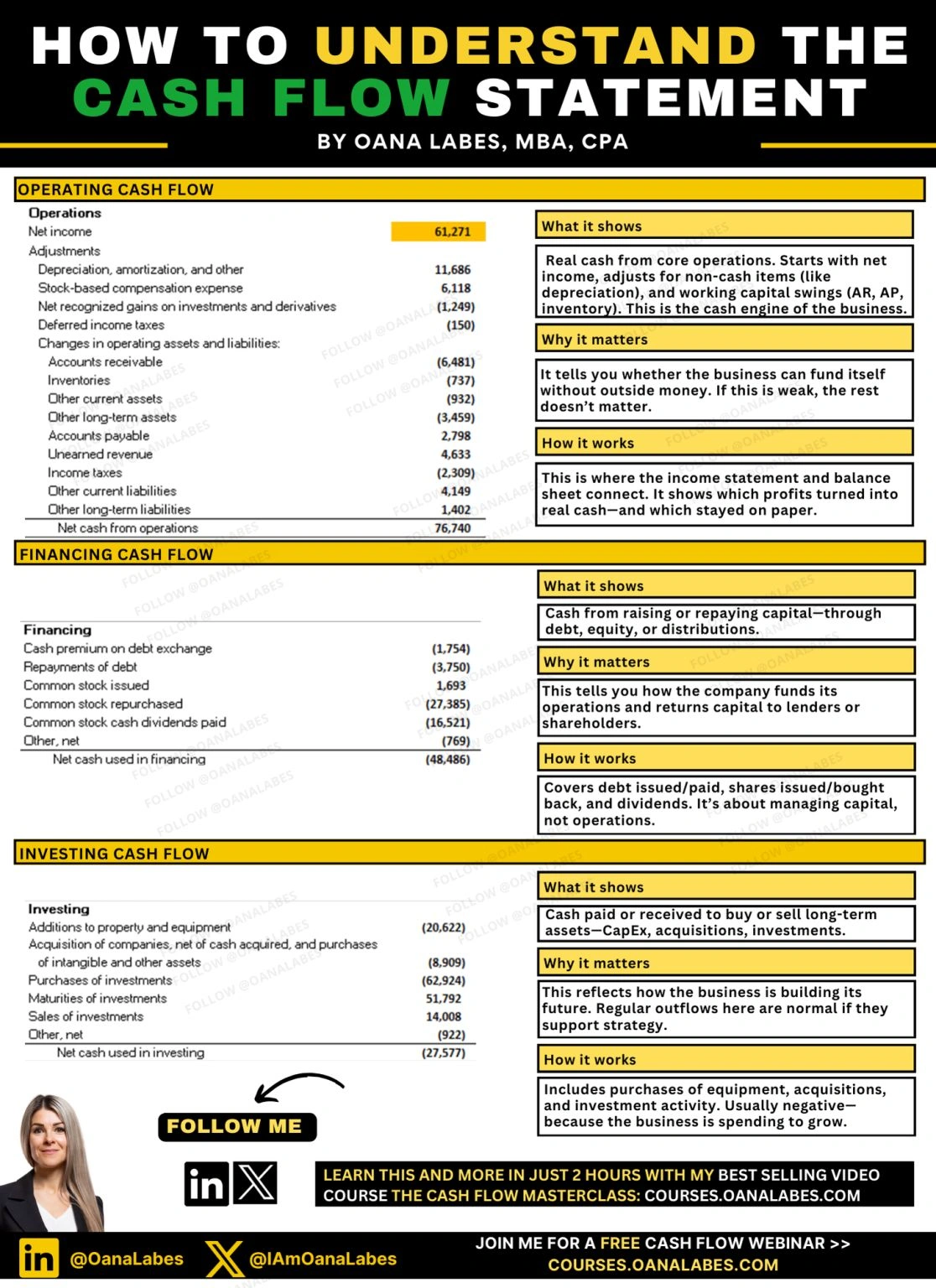

make smarter business decisions and ultimately avoid running out of runway. estimates in a cash flow forecast are largely based on historical business performance benchmarks, helping you create a cash outlook that is as accurate as possible for any given time period, be that a week, a month, a quarter, or a year. Keep in mind that the further out you’re forecasting, the greater the likelihood for error since there are increased variables that could impact cash flow over an extended period. Note, the key difference between a cash flow forecast and a budget is that a budget traditionally gives you a big picture look at your company’s cash flow and planned spending, whereas a cash flow forecast focuses specifically on the month-by-month breakdown of your company’s cash position — i.e., the actual liquid cash you expect to have on hand at the end of each month.

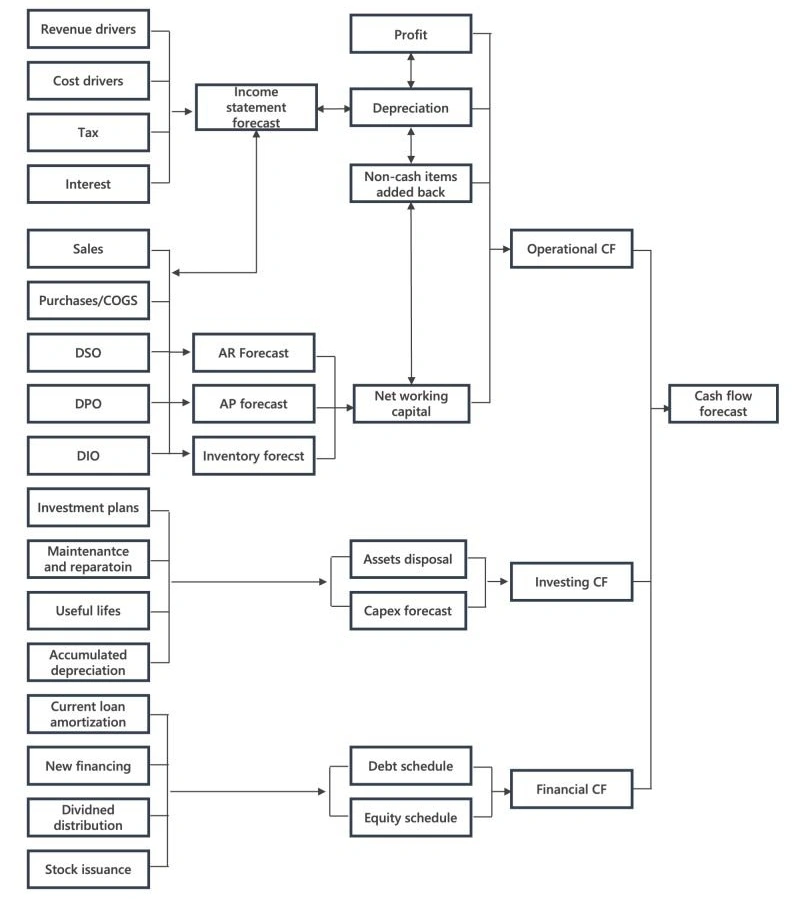

cash flow forecast is based on three core data sources:

- Opening balance: This is your cash position, the actual sum of cash that your startup will have at the beginning of a given period. It's typically pulled from your bank statement or balance sheet.

- Collected accounts receivables: These are the key cash inflows that are anticipated during the given period. A few things that might be covered in this section include: cash sales, customer deposits, financing, new investments, and interest income.

- Completed accounts payable: These are the expected expenses that will make up your cash outflows during a given period. A few things you might list out in this section of the forecast are rent, taxes, utilities, payroll, credit payments, software subscriptions, equipment, and vendor payments.

Cash Flow / Revenue Projections

Here's how to craft a cash flow projection pro forma that excites investors despite your startup currently breaking even:

Highlight Your Growth Potential:

- Focus on Future Growth: While breaking even is good, emphasize the projected increase in revenue over the next few years. Show a clear path to profitability.

- Market Validation: Back up your projections with market research and industry trends that validate your growth potential.

Showcase Efficiency and Strong Cash Flow Management:

- Break Down Expenses: Detail your operating expenses and demonstrate a strong handle on cost control measures you've implemented.

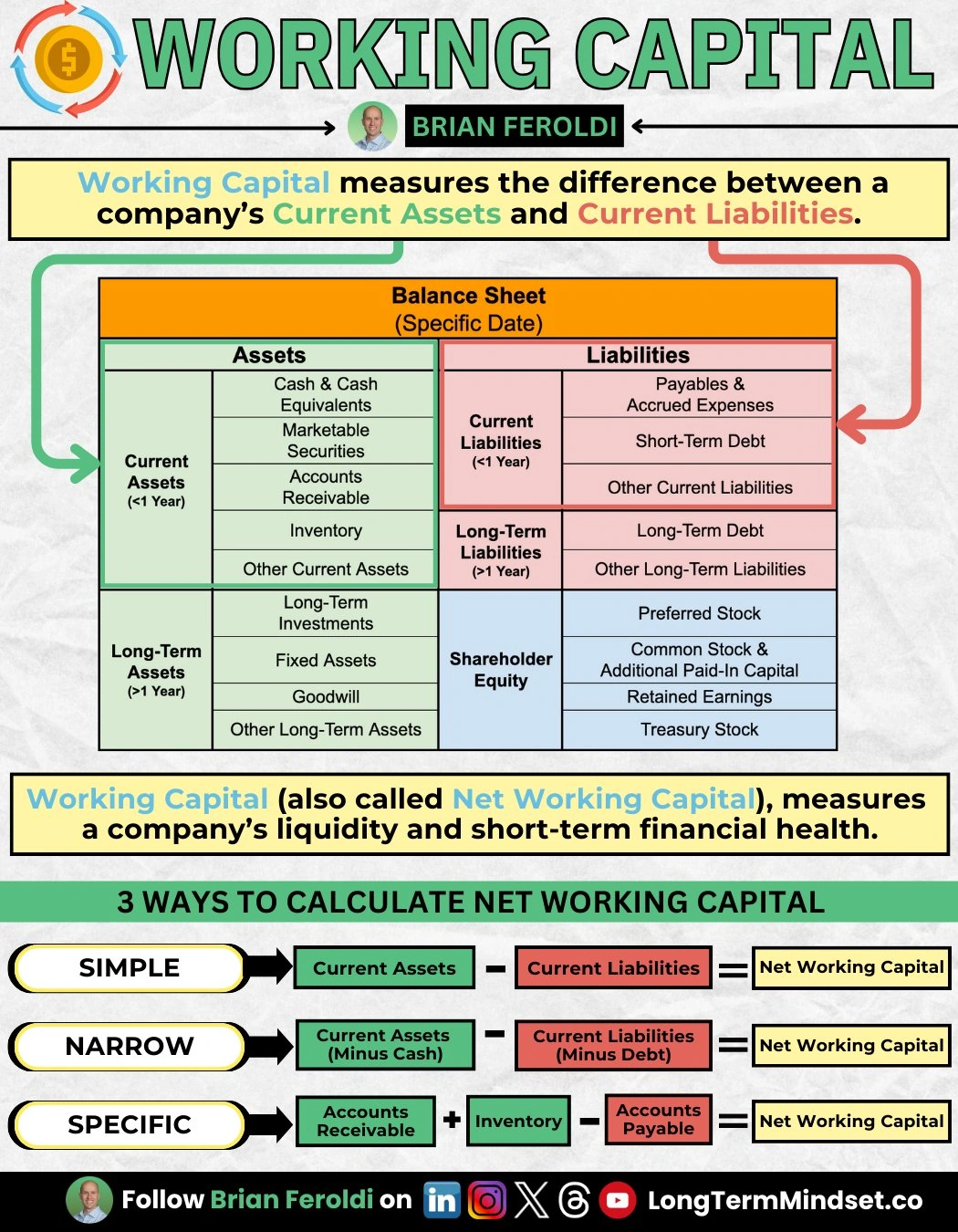

- Optimize Working Capital: Show how you're managing inventory and accounts receivable/payable efficiently to minimize cash flow strain.

Transparency and Realism:

- Multiple Scenarios: Include multiple cash flow forecasts based on different market conditions (optimistic, realistic, pessimistic).

- Clear Assumptions: Explain the reasoning behind your assumptions for revenue growth, expenses, and funding needs.

Presentation Matters:

- Visually Appealing: Use clear charts and graphs to present your cash flow projections. Keep it easy for investors to understand the story behind the numbers.

- Concise and Focused: Don't overwhelm investors with excessive data. Highlight key metrics and trends.

Beyond Breaking Even:

- Highlight Non-Monetary Growth: Demonstrate growth in user base, brand recognition, or strategic partnerships, even if it hasn't translated to profit yet.

Investor Mindset:

- Focus on Return on Investment (ROI): Project how your company will utilize the investment to generate future cash flow and returns for investors.

- Funding Milestones: Clearly outline how the requested investment will be used to achieve specific milestones that propel growth and profitability.

Remember: Breaking even signifies a solid foundation. By effectively communicating your growth plan, cost-consciousness, and a clear path to profitability, you can turn your pro forma into a compelling investment opportunity.

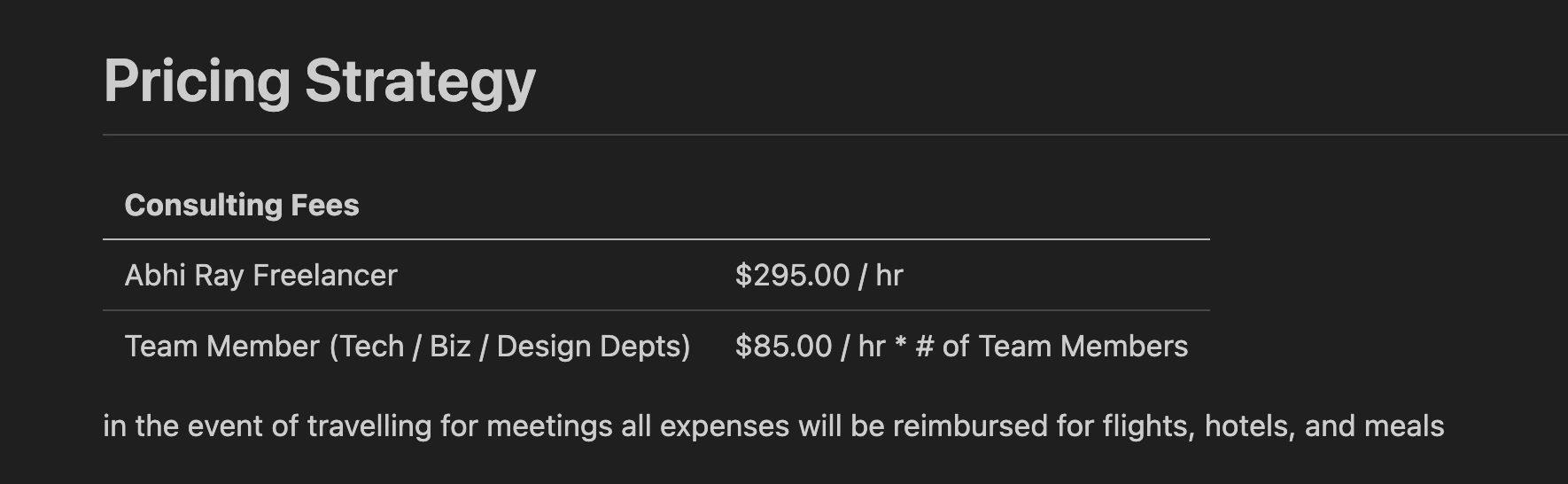

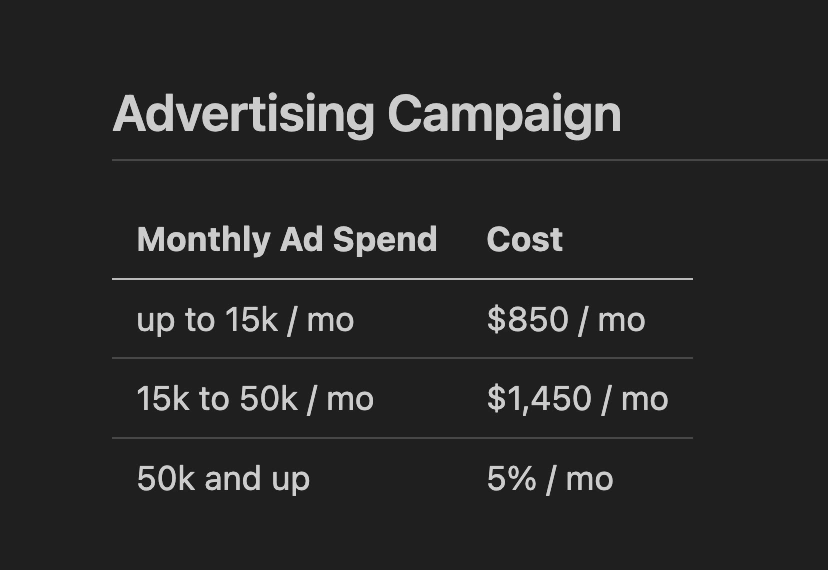

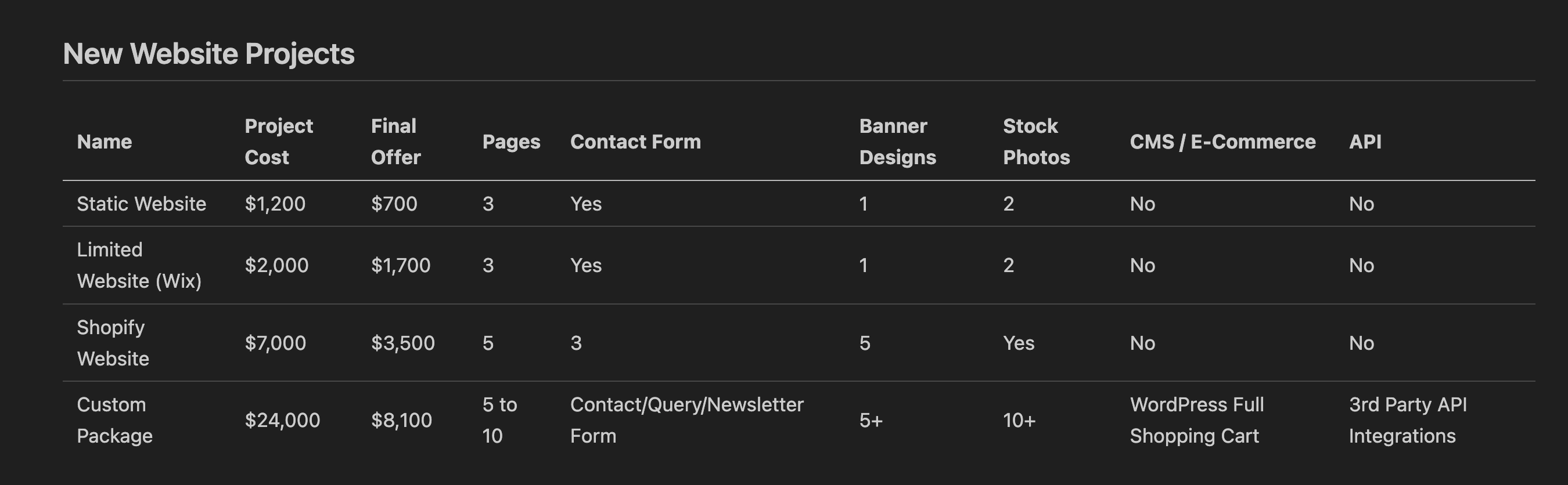

Pricing Strategy: The pricing strategy is an important factor in revenue projection, as it determines the revenue per unit sold. This may include different pricing for different product or service offerings, as well as volume discounts or promotional pricing.

Market Analysis: A market analysis helps to identify the size and potential of the target market, and to understand the competitive landscape. This information can be used to refine the sales forecast and pricing strategy, and to identify potential growth opportunities.

Marketing Plan: A marketing plan outlines the strategies and tactics that will be used to attract and retain customers. This may include advertising, public relations, social media, and other marketing channels.

Operating Expenses: Operating expenses are the costs associated with running the business, such as rent, utilities, salaries, and materials. These expenses must be factored into the revenue projection to determine the net income or profit.

Break-Even Analysis: A break-even analysis helps to determine the point at which the business will start generating a profit. This analysis considers the fixed and variable costs, as well as the revenue per unit sold, to determine the number of units that must be sold to break even.

Sensitivity Analysis: A sensitivity analysis helps to identify the potential impact of changes in key assumptions, such as sales growth rate, pricing strategy, or market size. This analysis can help to identify potential risks and opportunities, and to refine the revenue projection accordingly.

Overall, a revenue projection should be based on realistic assumptions and supported by data and analysis. By taking a strategic and data-driven approach to revenue projection, businesses can increase their chances of success and make informed decisions about investment and growth opportunities.

PRO FORMA CASH FLOW PROJECTION

A pro forma cash flow projection is a financial statement that estimates the amount and timing of cash inflows and outflows for a future period, typically 12 to 24 months. This is a common tool used by tech startups when pitching to investors to show how they intend to generate revenue and manage their cash flow.

sample pro forma cash flow projection for a tech startup

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash inflows | |||||||||||

| Investment | 500,000 | ||||||||||

| Revenue | 50,000 | 75,000 | 100,000 | 125,000 | 150,000 | 175,000 | 200,000 | 225,000 | 250,000 | 275,000 | 300,000 |

| Total cash inflows | 550,000 | 75,000 | 100,000 | 125,000 | 150,000 | 175,000 | 200,000 | 225,000 | 250,000 | 275,000 | 300,000 |

| Cash outflows | |||||||||||

| Operating expenses | 25,000 | 30,000 | 35,000 | 40,000 | 45,000 | 50,000 | 55,000 | 60,000 | 65,000 | 70,000 | 75,000 |

| Salaries and wages | 15,000 | 20,000 | 25,000 | 30,000 | 35,000 | 40,000 | 45,000 | 50,000 | 55,000 | 60,000 | 65,000 |

| Marketing and advertising | 5,000 | 10,000 | 15,000 | 20,000 | 25,000 | 30,000 | 35,000 | 40,000 | 45,000 | 50,000 | 55,000 |

| Rent and utilities | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 |

| Equipment purchases | 10,000 | ||||||||||

| Loan payments | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 |

| Total cash outflows | 67,500 | 72,500 | 87,500 | 103,000 | 118,500 | 134,000 | 149,500 | 165,000 | 180,500 | 196,000 | 211,500 |

| Net cash flow | 482,500 | 2,500 | 12,500 | 22,000 | 31,500 | 41,000 | 50,500 | 59,000 | 69,500 | 79,000 | 88,500 |

| Beginning cash balance | 482,500 | 485,000 | 497,500 | 519,500 | 551,000 | 592,000 | 641,500 | 699,000 | 764,500 | 838,000 | |

| Ending cash balance | 482,500 | 485,000 | 497,500 | 519,500 | 551,000 | 592,000 | 641,500 | 699,000 | 764,500 | 838,000 | 926,500 |

In this example, the startup begins with an investment of $500,000 in the first month. The company generates revenue that increases over time, while the cash outflows include operating expenses, salaries and wages, marketing and advertising, rent and utilities, and loan payments. The company also makes a one-time equipment purchase in the first month.

The net cash flow is calculated by subtracting the total cash outflows from the total cash inflows. The beginning cash balance for each month is the ending cash balance of the previous month, and the ending cash balance for the final month is the projected cash balance at the end of the 12-month period.

This pro forma cash flow projection can be used to show investors how the startup plans to generate revenue and manage its cash flow over the next year, which can help the investors makean informed decision about whether or not to invest in the company.