LLC Tax

Expense Categories

Schedule C

Schedule C is primarily for owners of a Single-Member LLC (SMLLC) that is taxed by default as a sole proprietorship.

Owners of a Multi-Member LLC (MMLLC) generally do not use Schedule C.

📝 Multi-Member LLC (MMLLC) Owner Tax Forms

By default, the IRS classifies an MMLLC as a Partnership. This requires a two-step process for tax reporting:

1. Business-Level Filing (MMLLC)

- The LLC files an informational return using IRS Form 1065, U.S. Return of Partnership Income. This form reports the LLC's total income, deductions, and profits/losses but does not pay federal income tax.

2. Member-Level Filing (Owner)

- The LLC issues a Schedule K-1 (Form 1065) to each member. This document reports the individual member's share of the LLC's income, deductions, credits, and any Guaranteed Payments.

- The individual member then uses the information from their Schedule K-1 to report their business income on their personal tax return, Form 1040, specifically using Schedule E, Supplemental Income and Loss.

Summary Table: Default LLC Tax Forms

| LLC Type (Default Tax Status) | LLC Files | Owner Reports on Form 1040 |

|---|---|---|

| Single-Member LLC (SMLLC) (Disregarded Entity / Sole Proprietorship) | None (Income reported on owner's return) | Schedule C |

| Multi-Member LLC (MMLLC) (Partnership) | Form 1065 | Schedule E (using data from Schedule K-1) |

📈 What Schedule C is For

Schedule C, Profit or Loss from Business (Sole Proprietorship), is the form used by self-employed individuals to report the income and expenses of their business.

- An SMLLC is a "disregarded entity" for tax purposes, meaning the IRS treats the LLC as if it doesn't exist. The sole owner is treated as a sole proprietor, and thus they report all business activity directly on their personal tax return using Schedule C.

- This also means the profit reported on Schedule C is subject to Self-Employment Tax (for Social Security and Medicare).

Deductions

Home Office deduction

- Utilities (Water, gas, trash; NOT lawn care)

- WiFi

- Repairs (Must pertain to office space - Central a/c or heating counts)

- Depreciation

- Rent

- Mortgage Interest

- Security System

- Homeowner's Insurance

- Real Estate Taxes

Professional attire

This is the category that people find most confusing. It may seem like you should be able to deduct the cost of a suit you bought for a conference, but unfortunately suits aren’t at all deductible. Professional clothes such as suits or work dresses can be worn to events outside of the business, therefore you can’t deduct the cost. It’s not important whether you would wear the item outside of work, it just matters that it’s not distinctive enough to not wear it when you’re not on the job.

The online personality

If you produce video content online (tutorial videos, an online news broadcast, reviews), you likely invest in clothes to wear in front of the camera. Unfortunately, this type of clothing expense can’t be claimed; your outfits are suitable for wearing off camera as well. There was a similar case with a TV news anchor where she tried to deduct clothing costs, because the clothes she purchased followed guidelines set by her employer, the news channel. However, because the clothes were suitable for general wear, they were disqualified from being tax deductible. The lesson: even if you have a specific on-set wardrobe, it’s not a good idea to turn it into a tax break.

LLC Alternative Minimum Tax

The term "tentative minimum tax" does not specifically apply to LLCs (Limited Liability Companies). However, there is a concept known as the "Alternative Minimum Tax" (AMT) that may be relevant to LLCs and their owners. Let's explore the AMT and its implications for LLCs.

The Alternative Minimum Tax (AMT) is a parallel tax system in the United States designed to ensure that taxpayers who have certain deductions and credits pay a minimum amount of tax. It was originally intended to prevent high-income individuals and corporations from using excessive deductions and loopholes to avoid paying their fair share of taxes. However, the AMT can also affect some LLC owners.

Under the AMT, taxpayers must calculate their tax liability using regular tax rules and then calculate it again using AMT rules. They are required to pay the higher of the two amounts. The AMT rules disallow or limit certain deductions and exemptions that are allowed under the regular tax system.

For LLC owners, the AMT can come into play if they have significant amounts of tax preference items or certain deductions that are not allowed under the AMT rules. This can include items such as certain types of tax-exempt interest, certain deductions for state and local taxes, and certain incentive stock options, among others.

It's important to note that the AMT rules can be complex, and the specific implications for an LLC and its owners will depend on various factors, including the individual's overall tax situation and the specific tax preferences and deductions involved.

To determine how the AMT may apply to a specific LLC or its owners, it is advisable to consult with a qualified tax professional or accountant who can provide personalized guidance based on the relevant details and current tax laws. They will be able to assess the specific circumstances and provide accurate information regarding the potential impact of the AMT on an LLC and its owners.

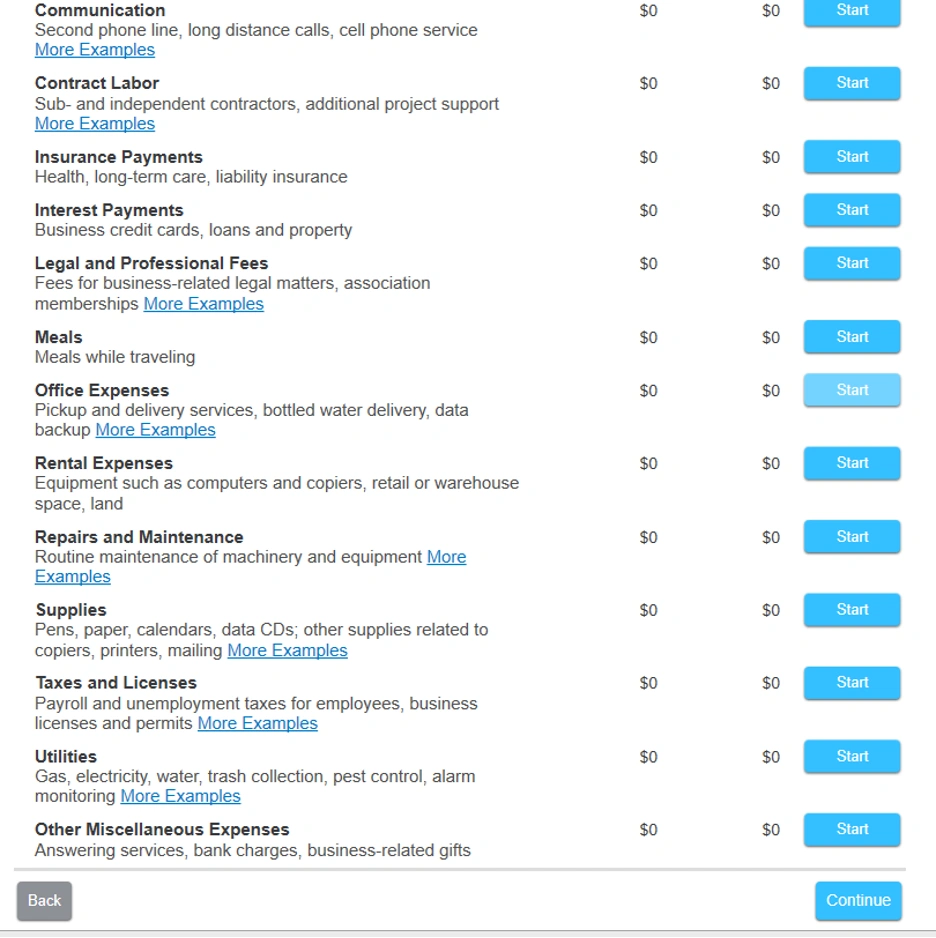

What Expenses meet the criteria?

- Wages

- Supplies

- Contract Research

- "Rental/Lease"? of computers

- software licenses do not qualify

Schedule C

Business expenses for your LLC

Receipts, invoices, bank statements, and any other documentation related to business expenses you incurred

Reporting Losses

If your LLC is not making a profit and is instead experiencing net losses, you can generally report these losses on your personal tax return using Schedule C, which is the form used to report business income or loss for a sole proprietorship or single-member LLC. The losses may help offset other income you have, such as income from a job or other sources.

Business vs. Hobby

It's important to establish that your LLC is genuinely engaged in a business activity rather than a hobby. The Internal Revenue Service (IRS) has specific criteria to determine whether an activity is considered a business or a hobby. Generally, a business is considered to have a profit motive if it is operated with the intention of making a profit. If the IRS determines that your activity is a hobby, deductions may be limited.

Reasonable Profit Expectation

Although turning a profit is not a requirement in every year, the IRS may scrutinize businesses that consistently report losses. To demonstrate that you have a genuine profit motive, it's helpful to maintain thorough and accurate business records, develop a business plan, and show that you are taking steps to improve profitability in the future.

Loss Limitations

If your losses exceed your income from other sources, you may not be able to deduct the full amount of the losses in the current year. Instead, you may need to carry forward the excess losses to future years and offset them against future profits. The rules for loss limitations can be complex, so it's advisable to consult a tax professional to ensure compliance.

Self-Employment Taxes

As a self-employed individual, you may be subject to self-employment taxes, which consist of both the employer and employee portions of Social Security and Medicare taxes. These taxes are typically calculated based on the net income from your business. However, if your net income is low or you're incurring losses, your self-employment tax liability may be reduced.

Hobby Loss Rules

The IRS has specific guidelines known as the "hobby loss rules" that determine whether an activity is engaged in for profit or as a hobby. If the IRS determines that your LLC is a hobby rather than a business, you may face limitations on the deductions you can claim. Generally, if your LLC has losses in three out of five consecutive years (two out of seven years for certain horse-related activities), the IRS may consider it a hobby and disallow deductions beyond the income generated by the activity.

Passive Activity Losses

If your LLC qualifies as a passive activity, such as rental real estate or limited partnership interests, there are additional limitations on deducting losses. The losses from passive activities can only be offset against income generated from other passive activities. If there is no passive income, the losses may be suspended and carried forward to future years when there is passive income or when you dispose of the activity.

At-Risk Rules

The IRS also applies at-risk rules to limit the deduction of losses from certain activities, such as investments made with borrowed funds. These rules restrict the loss deductions to the amount you have at risk in the activity. If you're not personally liable for the debts related to the activity or have made non-recourse loans, your losses may be limited.

Capital Loss Limitations

If your LLC incurs losses from the sale or disposition of capital assets, such as property or investments, there are specific rules governing the deductibility of these losses. Capital losses can generally be used to offset capital gains, and any excess losses can be used to offset other types of income, up to certain limits. If the losses exceed the allowable limits, they may be carried forward to future years.

Audit Risk

Consistently reporting losses or failing to reach a reasonable profit expectation may increase the likelihood of an IRS audit. While the IRS recognizes that businesses can have legitimate reasons for losses or slow growth, they also want to ensure that taxpayers are not abusing the tax system by claiming losses for non-business or hobby activities.

IRS considerations to determine whether an activity is engaged in for profit (business) or as a hobby

These guidelines consider various factors that can indicate the presence or absence of a profit motive. While no single factor is decisive, the IRS looks at the overall facts and circumstances of each case. Here are some key factors the

Profit Intent

The most crucial factor is whether you have a genuine intention to make a profit. The IRS will assess whether you conduct the activity in a business-like manner and maintain accurate books and records. A clear profit motive includes factors such as having a business plan, seeking advice from experts, making efforts to increase profitability, and adapting your methods based on business considerations.

Expertise

Your level of expertise or knowledge in the activity is considered. If you have extensive experience or qualifications in the field, it may suggest a profit motive. However, lack of expertise doesn't necessarily mean the activity is a hobby if you consult professionals or otherwise conduct the activity in a business-like manner.

Time and Effort

The amount of time and effort you devote to the activity is relevant. If you dedicate significant time and effort with the goal of making a profit, it supports the existence of a business. However, if the activity is sporadic, only done in your spare time, or primarily pursued for personal enjoyment, it may lean towards being a hobby.

History of Profits or Losses

The IRS considers your past performance and whether you have made a profit in similar activities in the past. A history of consistent profits suggests a profit motive, while a history of losses or sporadic profits may lean towards a hobby. However, occasional losses alone do not necessarily classify an activity as a hobby.

Financial Status

The IRS may look at your overall financial status to determine if the activity is being used to generate income necessary for your livelihood. If the activity is essential for your sustenance, it may indicate a profit motive.

Personal Enjoyment

While personal enjoyment is not necessarily incompatible with a profit motive, an activity primarily pursued for personal pleasure or recreational purposes may be considered a hobby.

Remember that these factors are not applied in isolation, and the determination depends on the overall facts and circumstances. If the IRS determines that your activity is a hobby, deductions may be limited to the income generated by the activity, and you may not be able to deduct losses.