S-Corp Tax

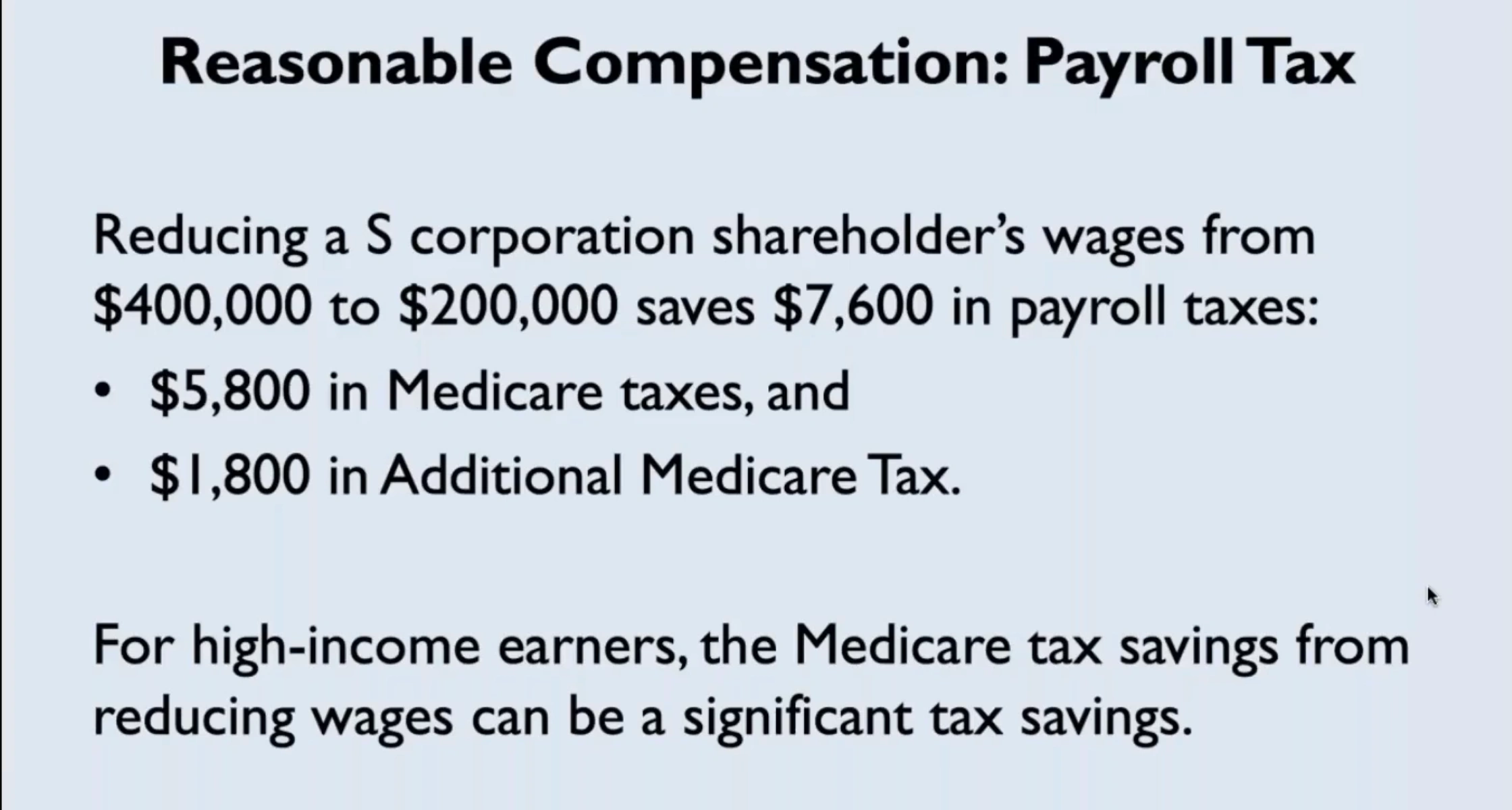

Payroll Tax

How do you calculate reasonable compensation?

How do you calculate reasonable compensation?

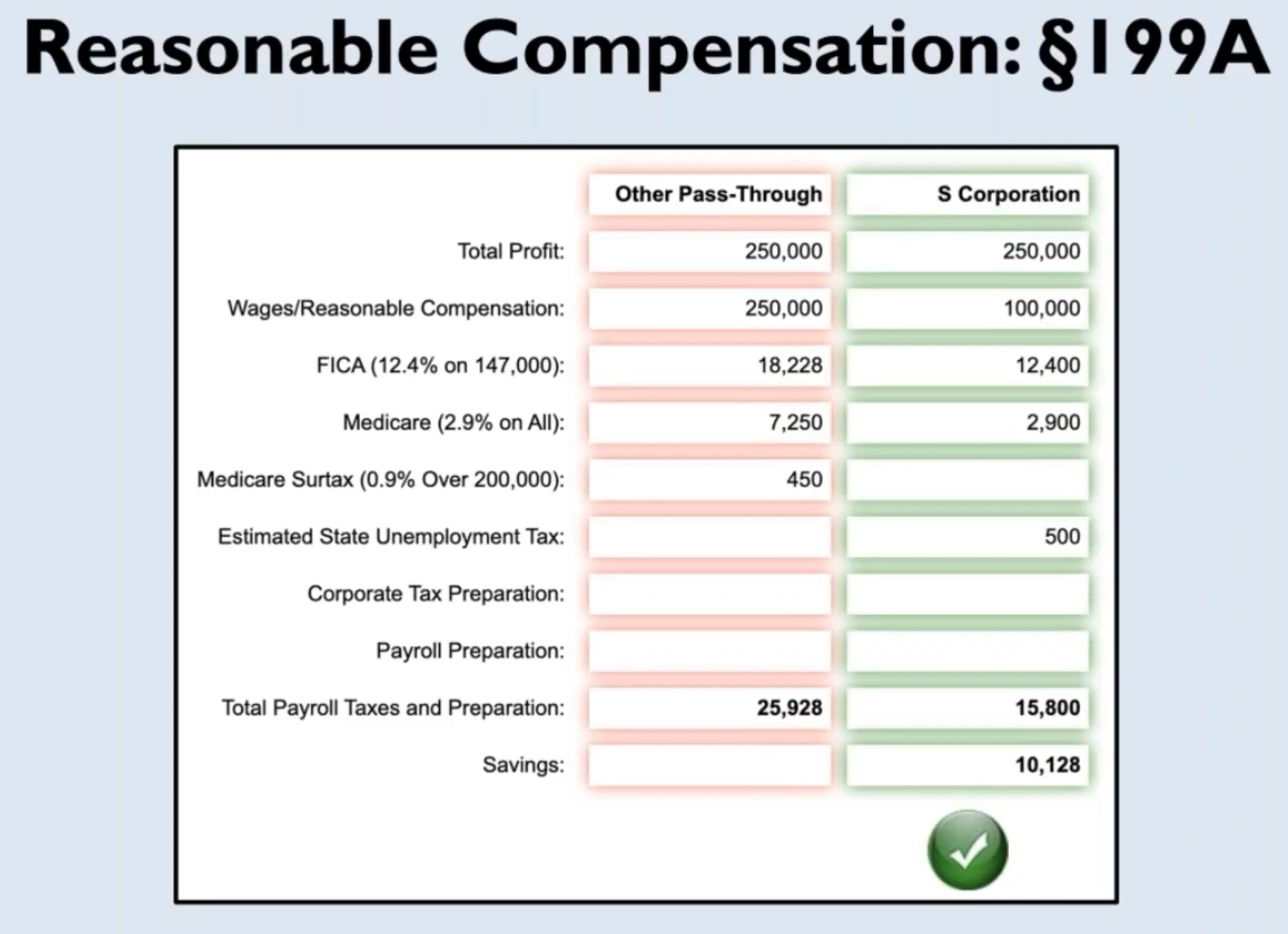

Qualified Business Income (QBI)

Research and Development Tax Credit

If the AMT liability is higher than the regular tax liability, the R&D tax credit can be used to offset the regular tax liability but not the AMT liability. However, any unused R&D tax credit can be carried forward to future years.

- federal credit can be $79,000 + state incentives

- any company with a repeatable, technical (problem solving) process

https://gusto.com/blog/taxes/research-development-tax-credit

- enacted in 1981 Economic Recovery Act (Reagan)

- Protecting Americans from Tax Hikes (PATH) Act of 2015 made credit permanent

- Activities based tax credit based on IRC ~41 & ~174

- qualified research activities + qualified research expenses = R&D Tax Credit

Schedule K-1 (partnerships or S corporations)

Schedule K-1 is a tax form used in the United States to report income, deductions, and credits from partnerships, limited liability companies (LLCs), S corporations, estates, and trusts. It is also known as the "Partner's Share of Income, Deductions, Credits, etc."

When a business entity operates as a partnership, LLC, S corporation, estate, or trust, it typically does not pay income taxes at the entity level. Instead, the income, deductions, and credits of the business are passed through to the owners or beneficiaries, who are responsible for reporting and paying taxes on their respective shares.

The Schedule K-1 is filed by the entity with the Internal Revenue Service (IRS) and provides detailed information to the owners or beneficiaries about their share of the entity's income, losses, deductions, and credits. Each partner, member, shareholder, or beneficiary receives a copy of Schedule K-1, which they use to report their share of the entity's activity on their individual tax returns.

The Schedule K-1 includes various sections that report different types of income, such as ordinary business income, rental income, interest income, capital gains, and more. It also provides information about deductions and credits allocated to the partner or beneficiary.

-

Entity Types: Schedule K-1 is used for various types of entities, including partnerships, limited liability companies (LLCs) treated as partnerships, S corporations, estates, and trusts. Each of these entities has its own unique tax rules and requirements.

-

Partnership and LLC: In a partnership or LLC, the entity itself does not pay income taxes. Instead, the profits, losses, deductions, and credits "pass through" to the individual partners or members, who then include their share on their personal tax returns.

-

S Corporation: An S corporation is a special type of corporation that elects to pass corporate income, losses, deductions, and credits through to its shareholders. The Schedule K-1 for an S corporation provides information about the shareholder's share of the S corporation's activity.

-

Trusts and Estates: Trusts and estates also use Schedule K-1 to report income, deductions, and credits to beneficiaries. The K-1 for trusts and estates may include information about interest, dividends, rental income, capital gains, and other types of income generated by the trust or estate.

-

Reporting Information: Schedule K-1 provides detailed information about the partner's or beneficiary's share of the entity's financial activity. This includes information such as the partner's share of ordinary business income, self-employment income, rental income, interest income, dividends, capital gains, deductions, and credits.

-

Tax Treatment: The income, losses, deductions, and credits reported on Schedule K-1 are typically subject to taxation at the individual level. The partner or beneficiary includes the information from the K-1 on their personal tax return and pays taxes based on their individual tax rates.

-

Filing Deadlines: The entity that issues the Schedule K-1 is responsible for filing it with the IRS. Partners, members, shareholders, or beneficiaries receive a copy of their K-1 and use it to complete their individual tax returns. The deadline for filing Schedule K-1s with the IRS is generally the same as the deadline for filing the entity's tax return, which is typically March 15 for partnerships and S corporations, and April 15 for individual tax returns.

It's important to note that the specific requirements and reporting details of Schedule K-1 can vary depending on the type of entity (partnership, LLC, S corporation, estate, or trust) and the tax laws in effect. Therefore, it's advisable to consult with a qualified tax professional or accountant for accurate guidance and assistance when dealing with Schedule K-1.