R&D Tax Credit

- new or improved business component, uncertainty, experimentation, technological science

- any company developing software

- manufacturer, electronics maker, any company investing in an internal software tool or upgrading their tech stack

- software development

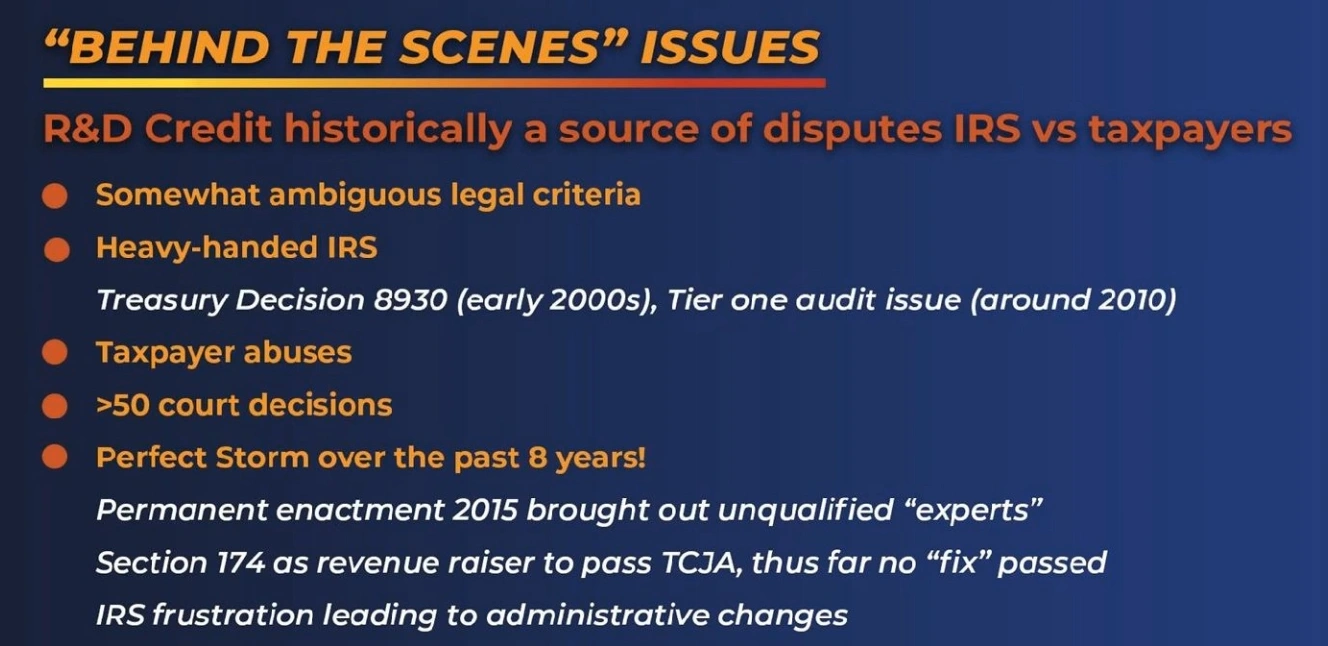

Form 6765 - Qualified Research Expenses (QREs)

calculating on a business component basis

no longer a quick process

- quick and easy calculations are a thing of the past

- additional time & expertise necessary to claim R&D Credit

- IRS gathering key indicators on each R&D claim

- tax preparers must review more info prior to signing

- IRS will select complex/shaky claims for audit

- inexperienced R&D consultants will struggle to comply

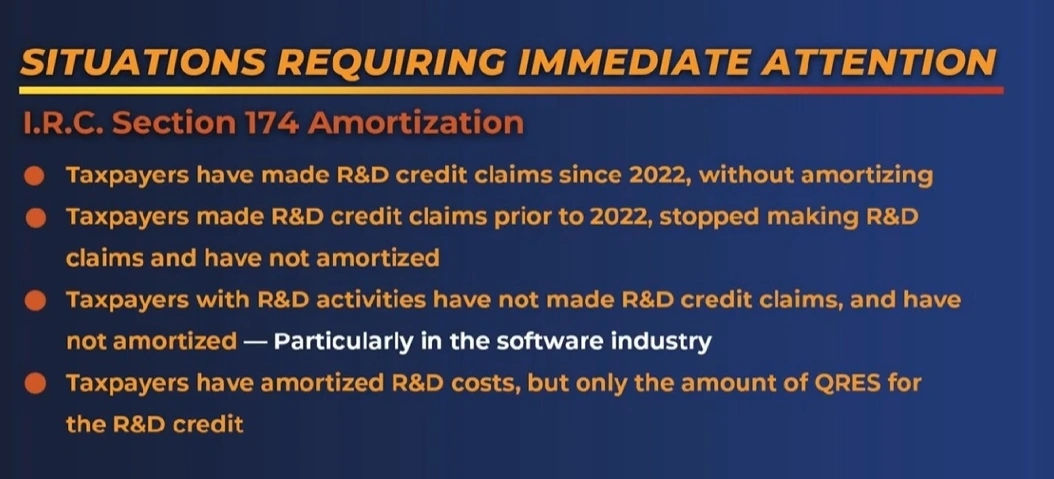

R&D Amortization

- how do you allocate G&A expense with R&D expense for items like rent, labor?

- Domestic R&D Costs amortized over 5 years

- Foreign R&D costs amortized over 15 years

- software development expenses considered R&D

- significant short-term increase in tax burden

- analysis required

Section 174

Historically R&D costs could be 100% deducted in curent year. beginning in 2022, all taxpayers must capitalize and amortize R&D costs.

- IRS Notice 2023-63 issued Sept 2023 is a detailed guide

- Notice 2024-12

- Rev. Proc. 2024-9 in 12-2023

The R&D tax credit can be carried forward for up to 20 years if not fully utilized, allowing start-ups to benefit from this tax incentive as they grow.

PATH Act of 2015

The R&D tax credit can significantly impact tech start-ups with bootstrap funding by providing a potential source of tax savings that directly reduces their financial burden. Here are some key points:

-

Eligibility for Start-ups: Tech start-ups may qualify for the R&D tax credit if they engage in developing new or improved software, processes, or products. This includes activities that enhance functionality, performance, or reliability.

-

Offsetting Payroll Taxes: Start-ups with less than $5 million in gross receipts can apply up to $250,000 of the R&D credit against their payroll taxes for up to five years. This can provide crucial cash flow support in the early stages.

-

Retroactive Claims: Start-ups can potentially claim R&D credits for up to three prior open tax years, allowing them to recover funds that can be reinvested into the business.

-

Documentation Requirements: While claiming the credit, start-ups need to maintain thorough documentation of their R&D activities. This includes payroll records, project notes, and other relevant documents to substantiate their claims.

-

No Need for Large R&D Departments: Start-ups do not need extensive R&D facilities or a team of scientists. Qualifying activities can occur in various settings, such as during product development or testing phases.

-

Long-term Benefits: The R&D tax credit can be carried forward for up to 20 years if not fully utilized, allowing start-ups to benefit from this tax incentive as they grow.

By leveraging the , tech start-ups with bootstrap funding can enhance their financial viability, enabling them to invest more in innovation and development.

1. Financial Relief

The R&D tax credit can provide significant financial relief for tech start-ups that often operate on limited budgets. By allowing eligible businesses to claim credits against their payroll taxes, start-ups can recoup some costs associated with their R&D efforts, effectively reducing their cash burn rate.

2. Encouragement to Innovate

With the tax credit acting as a safety net, start-ups may be more willing to invest in innovative projects despite the inherent risks. The knowledge that they can offset some of their expenses through tax credits can encourage more aggressive R&D initiatives.

3. Access to Refundable Credits

For start-ups with gross receipts under $5 million and no federal tax liability, the ability to claim the R&D tax credit as a refundable credit (up to $250,000 over five years) is particularly beneficial. This ensures that even companies not yet profitable can still gain immediate financial benefits from their R&D activities.

4. Improved Cash Flow

By offsetting payroll taxes, the R&D credit can improve a start-up's cash flow situation. This is critical for bootstrap-funded companies that may struggle with liquidity, allowing them to reinvest savings back into their business.

5. Competitive Advantage

Start-ups that effectively utilize the R&D tax credit can gain a competitive advantage over those that do not, as they can allocate more resources toward innovation and product development without the same financial constraints.

6. Long-Term Sustainability

The permanency of the R&D tax credit helps start-ups plan for the long term. Knowing that this credit will be available can influence their strategic decisions regarding scaling and investing in new technologies.

Conclusion

Overall, the R&D tax credit presents a valuable opportunity for tech start-ups with bootstrap funding to reduce financial burdens, encourage innovation, and enhance their sustainability in a competitive market. By leveraging this credit, these companies can focus on growth and development rather than solely on short-term financial survival.